0000066740DEF 14Afalse00000667402023-01-012023-12-31000006674042023-01-012023-12-31000006674012023-01-012023-12-31000006674052023-01-012023-12-31000006674022023-01-012023-12-31000006674062023-01-012023-12-31000006674032023-01-012023-12-31000006674072023-01-012023-12-31iso4217:USDxbrli:pure00000667402022-01-012022-12-3100000667402021-01-012021-12-3100000667402020-01-012020-12-310000066740ecd:PeoMembermmm:ChangeInPensionValueMember2023-01-012023-12-310000066740ecd:PeoMembermmm:PensionAdjustmentsServiceCostMember2023-01-012023-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000066740ecd:PeoMembermmm:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2023-01-012023-12-310000066740ecd:PeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310000066740ecd:PeoMembermmm:ChangeInPensionValueMember2022-01-012022-12-310000066740ecd:PeoMembermmm:PensionAdjustmentsServiceCostMember2022-01-012022-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000066740ecd:PeoMembermmm:EquityAwardsGrantedDuringTheYearUnvestedMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-01-012022-12-310000066740ecd:PeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000066740ecd:PeoMembermmm:ChangeInPensionValueMember2021-01-012021-12-310000066740ecd:PeoMembermmm:PensionAdjustmentsServiceCostMember2021-01-012021-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000066740ecd:PeoMembermmm:EquityAwardsGrantedDuringTheYearUnvestedMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-01-012021-12-310000066740ecd:PeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000066740ecd:PeoMembermmm:ChangeInPensionValueMember2020-01-012020-12-310000066740ecd:PeoMembermmm:PensionAdjustmentsServiceCostMember2020-01-012020-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000066740ecd:PeoMembermmm:EquityAwardsGrantedDuringTheYearUnvestedMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-01-012020-12-310000066740ecd:PeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310000066740ecd:NonPeoNeoMembermmm:ChangeInPensionValueMember2023-01-012023-12-310000066740mmm:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:NonPeoNeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2023-01-012023-12-310000066740ecd:NonPeoNeoMembermmm:ChangeInPensionValueMember2022-01-012022-12-310000066740mmm:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:NonPeoNeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310000066740ecd:NonPeoNeoMembermmm:ChangeInPensionValueMember2021-01-012021-12-310000066740mmm:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:NonPeoNeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310000066740ecd:NonPeoNeoMembermmm:ChangeInPensionValueMember2020-01-012020-12-310000066740mmm:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740mmm:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedDuringTheYearVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740mmm:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:NonPeoNeoMembermmm:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

3M Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | |

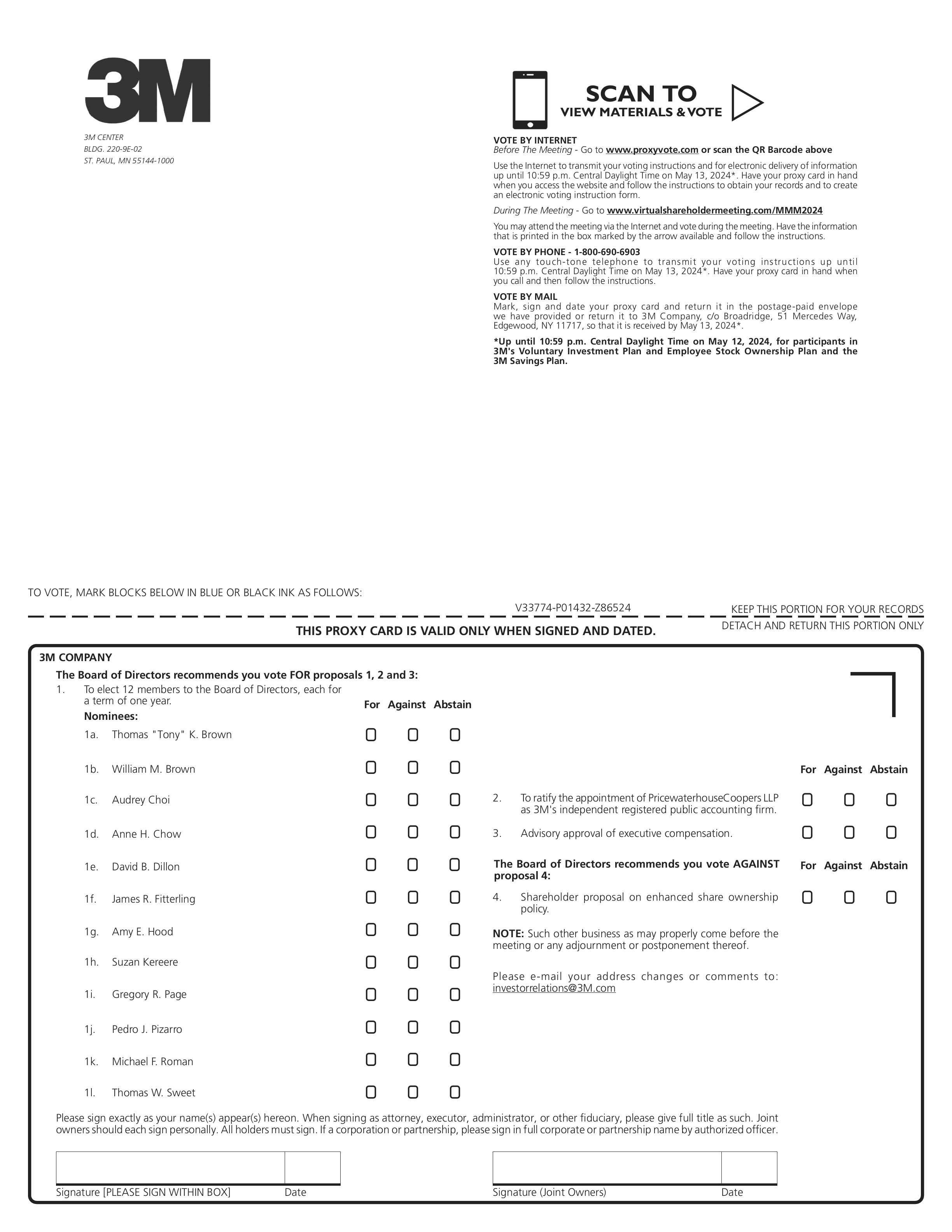

| | | | March 27, 2024 Dear Shareholder: On behalf of the Board of Directors and our senior management team, we are pleased to invite you to attend 3M’s Annual Meeting of Shareholders on Tuesday, May 14, 2024, at 8:30 a.m., Central Daylight Time at www.virtualshareholdermeeting.com/MMM2024. To leverage technology to enable shareholder participation from any location, the 2024 Annual Meeting will be held exclusively online. In 2023, the 3M team executed our plans and delivered on our commitment to exit the year stronger, leaner and more focused. We improved our operational performance, advanced the spin-off of our Health Care business, and reduced risk and uncertainty. We implemented the most significant restructuring in 3M history, aggressively cut management layers, simplified our supply chains and streamlined our global go-to-market models. Our actions supported strong underlying margins and robust cash flow. We continued investing in the business, while reducing net debt and returning $3.3 billion to you, our shareholders, through our dividend. Importantly, we continued to do what 3M does best: use material science to make a difference in the world. 3M is well positioned to build on our progress in 2024. We will focus on further improving our operational performance, accelerating efforts to optimize our portfolio, and addressing legal matters. We will also continue to invest in high-growth markets where 3M’s unique capabilities can make a difference, including automotive electrification, climate technology, and industrial automation. As recently announced, we are excited about William Brown joining us as our next Chief Executive Officer, starting May 1, 2024, and building on our momentum and progress to move 3M forward. We are confident in our future, and our ability to deliver greater value for our customers, our shareholders, and all who have placed their trust in us. We sincerely hope you will join us at our virtual Annual Meeting. You will have a chance at the meeting to vote on the matters set forth in the accompanying Notice of Annual Meeting and Proxy Statement. There will also be time for your questions and comments. Shareholders who wish to submit questions in advance of the meeting may do so by using their 16-digit control number to access www.proxyvote.com. For information on how to attend the meeting, please read “Participating in the virtual annual meeting” on page 132 of the accompanying Proxy Statement. Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. You may vote your proxy on the Internet, by telephone, or if this Proxy Statement was mailed to you, by completing and mailing the enclosed traditional proxy card. Please review the instructions on the proxy card or the electronic proxy material delivery notice regarding each of these voting options. Thank you for your ongoing support of 3M. |

| | | |

| | | |

| | | |

| | | |

| | | |

| Sincerely, Michael F. Roman Chairman of the Board and Chief Executive Officer | |

| | | |

| James R. Fitterling Lead Independent Director* (*Effective April 3, 2024) | |

| | | | | | | | | | | |

| | | |

| | Time and Date 8:30 a.m., Central Daylight Time Tuesday, May 14, 2024 | |

| | | |

| | Where Virtual only at www.virtualshareholder meeting.com/MMM2024 | |

| | | |

| | | |

| How to vote Whether or not you plan to attend the virtual meeting, please vote your proxy either by using the Internet or telephone as further explained in this Proxy Statement or by filling in, signing, dating, and promptly mailing a proxy card. | |

| | | |

| | By Telephone In the U.S. or Canada, you may vote your shares toll-free by calling 1-800-690-6903. | |

| | | |

| | By Internet You may vote your shares online at www.proxyvote.com. | |

| | | |

| | By Mail You may vote by mail by marking, dating, and signing your proxy card or voting instruction form and returning it in the postage-paid envelope. | |

| | | |

| | By Online Voting You may vote online at the virtual Annual Meeting. | |

| | | |

| | | |

Important Notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on May 14, 2024. The Notice of Annual Meeting, Proxy Statement, and 2023 Annual Report are available at www.proxyvote.com. Enter the 16-digit control number located in the box next to the arrow on the Notice of Internet Availability of Proxy Materials or proxy card to view these materials. THIS PROXY STATEMENT AND PROXY CARD, AND THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, ARE BEING DISTRIBUTED TO SHAREHOLDERS ON OR ABOUT MARCH 27, 2024. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Items of business | Board

Recommendation | |

| | | | | | |

| | | | | | |

| 1. | Elect the 12 director nominees identified in the Proxy Statement, each for a term of one year. | | FOR | |

| | | |

| | | |

| 2. | Ratify the appointment of PricewaterhouseCoopers LLP as 3M’s independent registered public accounting firm for 2024. | | FOR | |

| | | |

| | | |

| 3. | Approve, on an advisory basis, the compensation of our Named Executive Officers. | | FOR | |

| | | |

| | | |

| 4. | Shareholder proposal, if properly presented at the meeting. | | AGAINST | |

| | | | | | |

| | | |

| | Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement. | | | |

| | | | | |

| | | | | | |

Record date You are entitled to vote if you were a shareholder of record at the close of business on Tuesday, March 19, 2024. Adjournments and postponements Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. Annual report Our 2023 Annual Report, which is not part of the proxy soliciting materials, is enclosed if the proxy materials were mailed to you. The Annual Report is accessible on the Internet by visiting www.proxyvote.com, if you have received the Notice of Internet Availability of Proxy Materials, or previously consented to the electronic delivery of proxy materials. By order of the Board of Directors, Michael M. Dai Vice President, Associate General Counsel and Secretary 3M Company 3M Center, St. Paul, Minnesota 55144 Attending the virtual Annual Meeting To leverage technology to enable shareholder participation from any location, the 2024 Annual Meeting will be held exclusively online. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/MMM2024, you need to enter the 16-digit control number on your proxy card, voting instruction form, or Notice of Internet Availability you previously received. See additional instructions on page 132. We have worked to offer the same participation opportunities as were provided at the in-person portion of our past meetings. At the virtual Annual Meeting, you or your proxy holder may participate, vote and examine a list of shareholders of record entitled to vote at the meeting by accessing www.virtualshareholdermeeting.com/MMM2024. If you wish to submit questions in advance of the virtual meeting, you may do so by using your 16-digit control number to access www.proxyvote.com. During the virtual meeting, you may type in your questions on the meeting website as well. See additional instructions on page 133. |

| | | | | | | | | | | |

| | | |

| Special Note About Forward-Looking Statements This proxy statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve risks and uncertainties that could cause results to differ materially from those projected. Please refer to the section entitled “Risk Factors” in our Forms 10-K and 10-Q. The information contained herein is as of the date of this proxy statement. We assume no obligation to update any forward-looking statements contained herein as a result of new information or future events or developments, except as required by law. No Incorporation By Reference This proxy statement includes website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein. | |

| | | |

| | | | | | | | | | | | | | |

| | | |

| Elect the 12 director nominees identified in this Proxy Statement (page 20) •Elect the 12 director nominees identified in this Proxy Statement, each for a term of one year. •Our nominees are distinguished leaders who bring a mix of skills and qualifications to the Board and can represent the interests of all shareholders. •As proven leaders, our nominees are well positioned to guide 3M’s strategic directions. •Our recent Board refreshment brings new skills and experience to the Board and enhances its oversight of various areas important to the Company. | |

| |

| | “FOR” each nominee to the Board | |

Corporate governance dashboard

Director nominees, board diversity of skills and experience

| | | | | | | | |

| | |

| | Thomas “Tony” K. Brown Retired Group Vice President,

Global Purchasing,

Ford Motor Company Skills Age 68 Tenure 2013 Committee A  |

|

|

| | |

| | |

| | William M. Brown Former Chairman of the Board and Chief Executive Officer,

L3Harris Technologies, and

Chief Executive Officer of 3M Company (effective May 1, 2024) Skills Age 61 Tenure New nominee |

|

|

| | |

| | |

| | Audrey Choi Retired Chief Sustainability Officer and Chief Marketing Officer, Morgan Stanley Skills Age 56 Tenure 2023 Committee N&G STS |

|

|

|

| | |

| | |

| | Anne H. Chow* Retired Chief Executive Officer,

AT&T Business Skills Age 57 Tenure 2023 Committee C&T STS |

|

|

| | |

| | |

| | David B. Dillon Retired Chairman of the Board

and Chief Executive Officer,

The Kroger Co. Skills Age 72 Tenure 2015 Committee  N&G N&G |

|

|

| | |

| | |

| | James R. Fitterling* Lead Independent Director Chair of the Board and Chief Executive Officer, Dow Inc. Skills Age 62 Tenure 2021 Committee  |

|

|

| | | | | |

| |

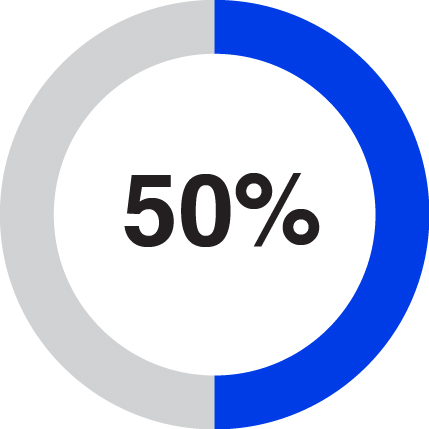

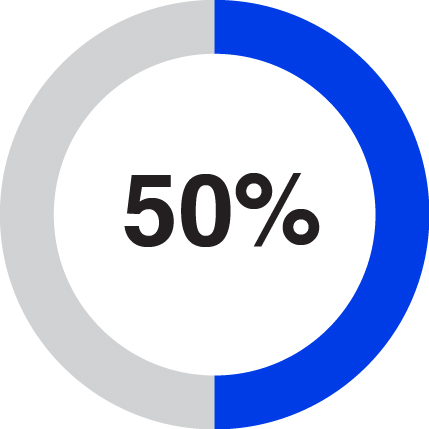

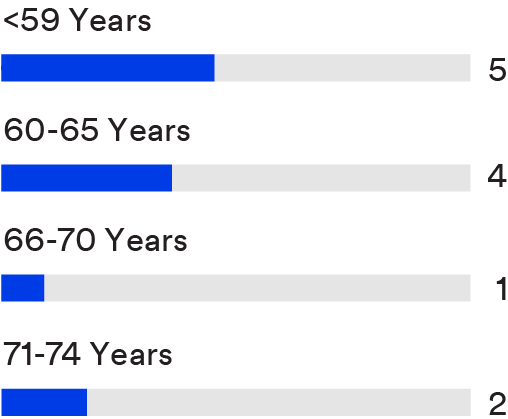

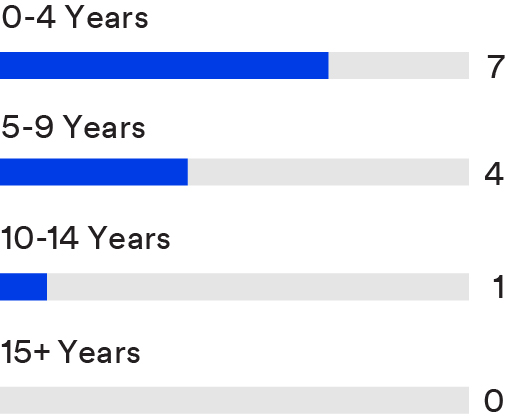

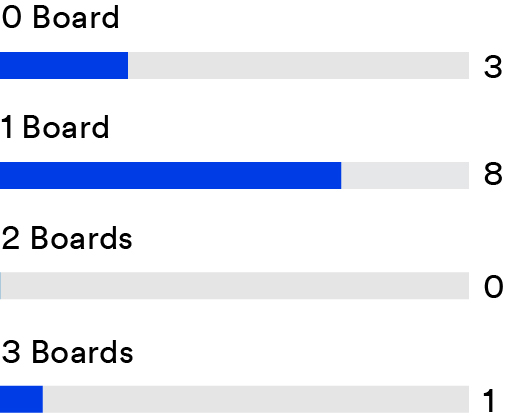

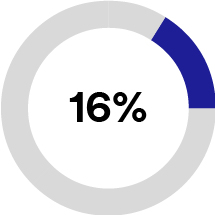

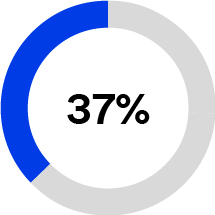

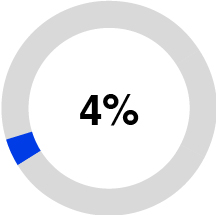

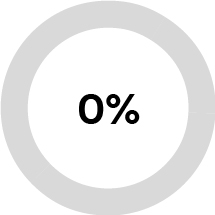

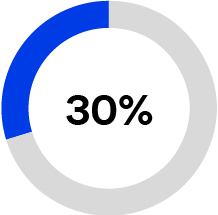

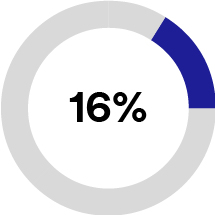

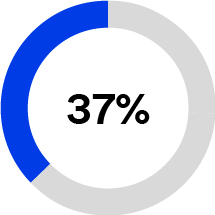

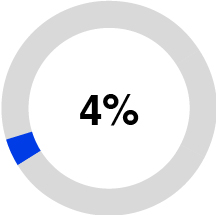

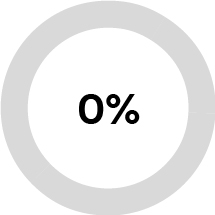

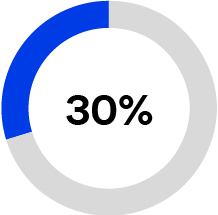

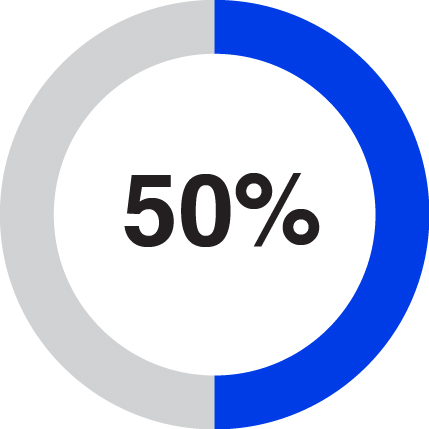

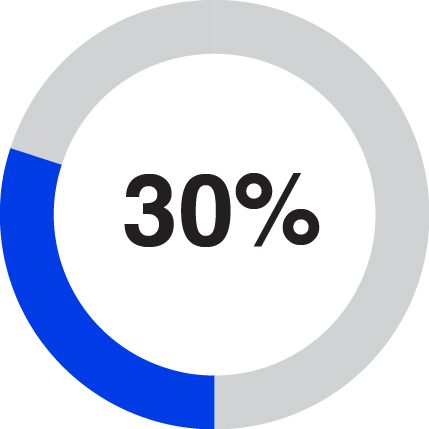

Director nominee age 62.0 Average years | Director nominee tenure 4.0 Average tenure |

| |

| |

Director nominee independence | Lead independent director •Lead Independent Director with robust authority •Separate Executive Chairman and CEO after transition |

|

|

|

| |

| |

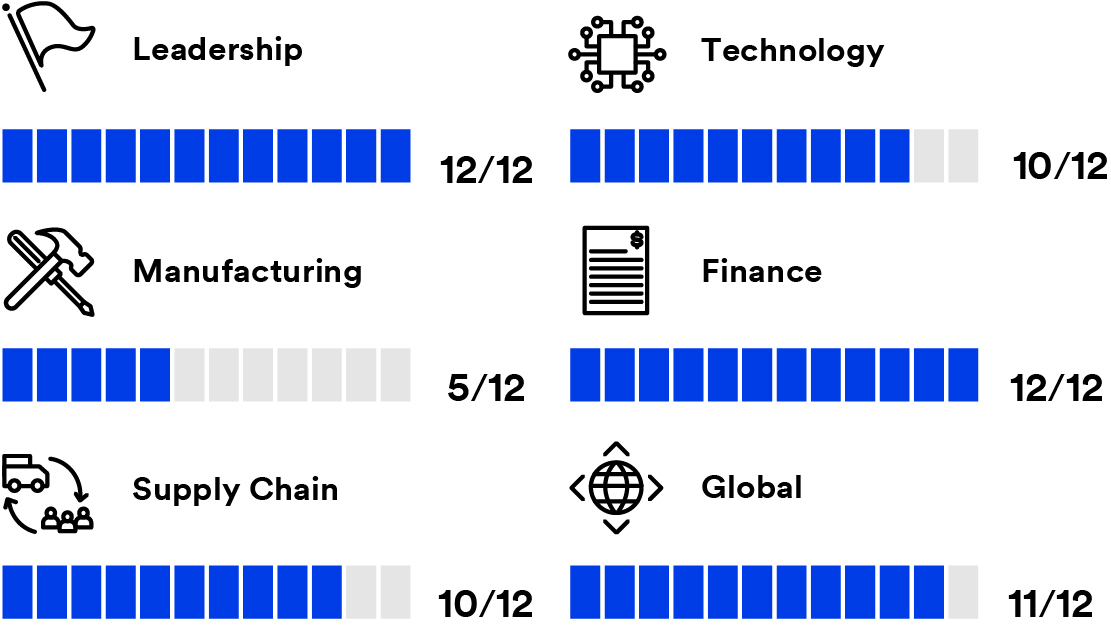

Skills and experience |

|

|

|

|

|

|

| | | | | | | | | | | |

| | | |

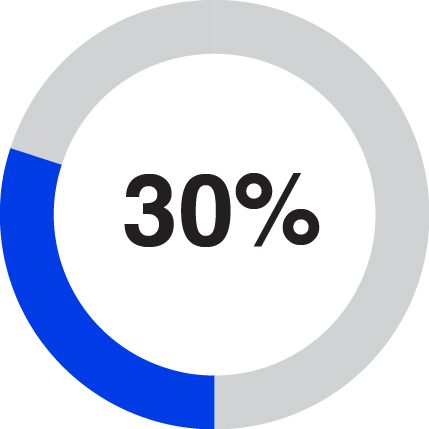

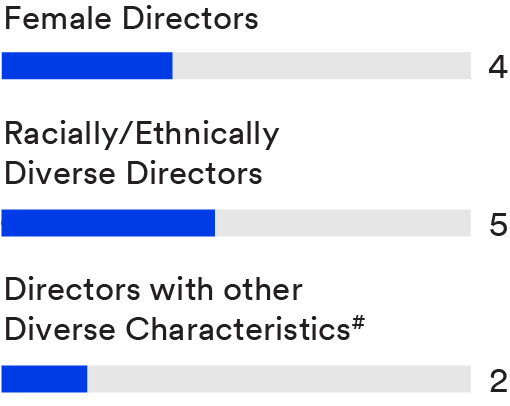

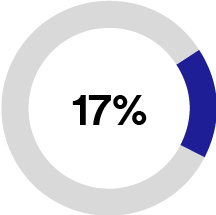

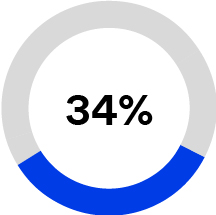

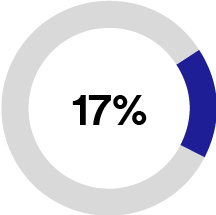

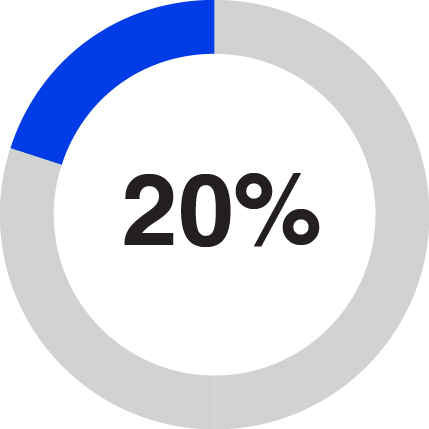

Other public company boards 0.9 Average board positions | Diversity 58.3% Diverse board members # LGBTQ+ or born outside of the U.S. |

| | |

| | | |

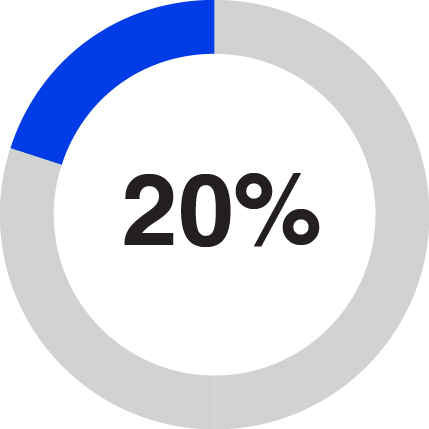

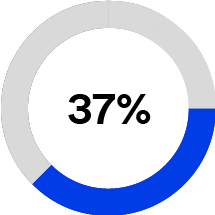

Meeting attendance 97% •Overall attendance at Board and committee meetings •There were 11 Board meetings in 2023 | Board changes since 2019 7 of 12 nominees will have joined the Board since 2019 if elected, including 3 women directors and 5 directors with other diverse traits |

|

|

|

| | |

| | |

| Key |

| Independent |

| Chair |

A | Audit |

C&T | Compensation and Talent |

N&G | Nominating and Governance |

| | STS | Science, Technology & Sustainability |

| | * | Effective April 3, 2024, Mr. Fitterling will assume the duties of Lead Independent Director and Ms. Chow will assume the role of C&T Chair. |

| | | | | | | | |

| | |

| | Amy E. Hood Executive Vice President

and Chief Financial Officer, Microsoft Corporation Skills Age 52 Tenure 2017 Committee C&T STS |

|

|

| | |

| | |

| | Suzan Kereere President, Global Markets, PayPal, Inc. Skills Age 58 Tenure 2022 Committee A C&T |

|

|

| | |

| | |

| | Gregory R. Page Retired Chairman of the Board and Chief Executive Officer, Cargill Skills Age 72 Tenure 2016 Committee C&T  |

|

|

| | |

| | |

| | Pedro J. Pizarro President and Chief Executive Officer and Director, Edison International Skills Age 58 Tenure 2023 Committee A N&G |

|

|

| | |

| | |

| | Michael F. Roman Chairman of the Board and

Chief Executive Officer,

3M Company Skills Age 64 Tenure 2019 |

|

|

| | |

| | |

| | Thomas W. Sweet Retired Chief Financial Officer,

Dell Technologies Skills Age 64 Tenure 2023 Committee A N&G |

|

Qualifications and attributes, and demographic information, for the 12 director nominees that are standing for election at the Annual Meeting are summarized below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Qualifications and Attributes | T. Brown | W. Brown | Choi | Chow | Dillon | Fitterling | Hood | Kereere | Page | Pizarro | Roman | Sweet |

| Leadership | | | | | | | | | | | | |

| Manufacturing | | | | | | | | | | | | |

| Supply Chain | | | | | | | | | | | | |

| Technology | | | | | | | | | | | | |

| Finance | | | | | | | | | | | | |

| Global | | | | | | | | | | | | |

| Risk Management | | | | | | | | | | | | |

| Marketing | | | | | | | | | | | | |

| Demographic Background | | | | | | | | | | | | |

| Tenure (Years) | 11 | 0 | <1 | 1 | 9 | 3 | 7 | 2 | 8 | 1 | 6 | <1 |

| Age (Years) | 68 | 61 | 56 | 57 | 72 | 62 | 52 | 58 | 72 | 58 | 64 | 64 |

| Gender (Male/Female) | M | M | F | F | M | M | F | F | M | M | M | M |

| Race/Ethnicity | | | | | | | | | | | | |

| African American/Black | | | | | | | | | | | | |

| Asian | | | | | | | | | | | | |

| Hispanic | | | | | | | | | | | | |

| Caucasian/White | | | | | | | | | | | | |

Corporate governance highlights

Board refreshment

We regularly add directors to infuse new ideas and fresh perspectives into the boardroom. Mr. William M. Brown, who was appointed by the 3M Board as Chief Executive Officer of 3M effective May 1, 2024, is standing for election to the 3M Board for the first time. In addition, six out of the eleven other director nominees standing for this year’s election have joined our board within the past five years, and five of these six nominees have diverse traits, such as gender, racial, or ethnic diversity. In recruiting directors, we focus on how the experience and skill set of each individual complements those of their fellow directors to create a balanced board with diverse viewpoints and backgrounds, deep expertise, and strong leadership experience.

Shareholder outreach and engagement

Shareholder engagement is fundamental to our commitment to good governance and essential to maintaining our strong corporate governance practices. We engage regularly with our global investors to share updates on our strategic, financial, and operating performance and to understand valuable shareholder perspectives on governance and sustainability issues about which they care most. We aim to seek a collaborative and mutually beneficial approach to issues of importance to investors that affect our business. Shareholder feedback is shared with the appropriate Board committees or the full Board to ensure our governance policies reflect priorities that are important to our shareholders.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

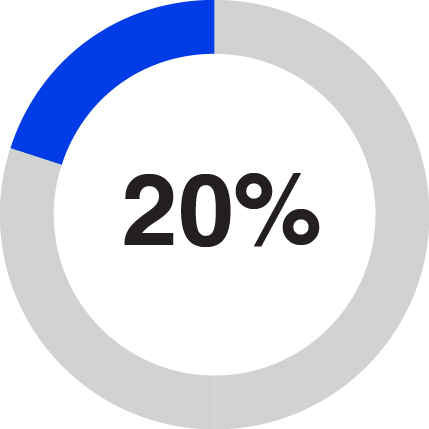

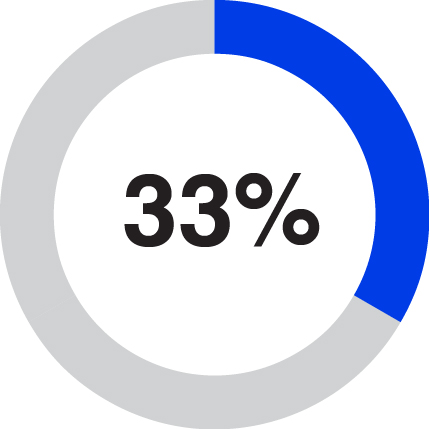

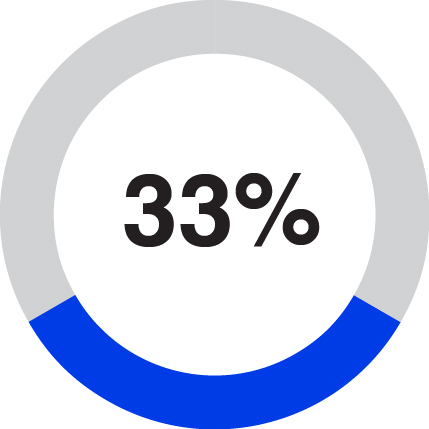

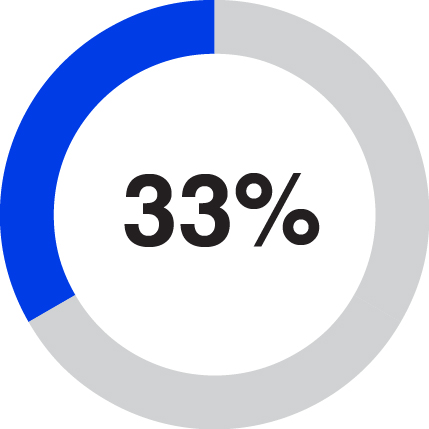

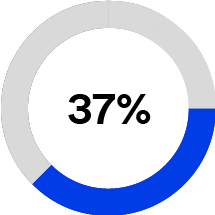

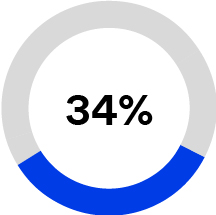

Participants | | | During 2023, members of senior management offered to meet with a cross-section of shareholders owning approximately: |

| | | 23% of our

outstanding

shares | or | | 35% of our

institutional

shareholders |

| | Two of our directors — our Chairman of the Board and the Chair of our Science, Technology & Sustainability Committee — participated in our 2023 engagement. |

| | | | | | | | |

| | | | | | | |

Topics Discussed | | | Board / Corporate governance •Board composition, including refreshment, skills matrix, and diversity •Director orientation, education, and evaluation •Risk oversight (sustainability and litigation/regulatory) Environmental / Social / Sustainability •Air and water stewardship goals, plastics reduction, and investments and pathway to achieve goals | Business •Update on Health Care business spin-off, including leadership, timing, and key milestones •Organic growth opportunities, research / development effectiveness, and portfolio •PFAS manufacturing exit update •Capital structure including impact of Health Care business spin-off, and dividend Litigation •Updates on key settlement agreements •Remaining PFAS-related litigation |

| | | | | | | | |

| | | | | | | |

Feedback Feedback | | | Investors provided valuable comments and perspectives on the above referenced topics. The feedback from these meetings was shared with the appropriate Board committees of the full Board and helped inform the Board on corporate governance practices and trends. |

3M’s sustainability highlights

In 2023, 3M continued to make progress toward our environmental goals, including helping to enhance the quality of water we return to the environment after use in our facilities. We are taking action to install state-of-the-art technologies and improve processes at many of our facilities globally, which is helping us to reduce our overall water use and positively impact water quality in 3M communities. Since announcing our carbon neutrality goal in 2019, we’ve seen a 43.2 percent reduction in scope 1 and 2 emissions. Since 2002, we’ve seen an overall 80.1 percent reduction, while our total revenues more than doubled. Since 2021, we’ve achieved a 69.8 million-pound reduction in the use of virgin fossil-based plastic in our packaging and products toward our goal of 125 million pounds by 2025. We’ve incorporated recycled and bio-based materials and reduced plastic use in products and packaging such as tapes and dispensers, sponges, packaging, workspace solutions, insulation, optical films, floor pads, sorbents, and more.

We advance meaningful actions toward a more equitable future for our global employee base, including training, development, and recruitment efforts focused on underrepresented populations as we continue our efforts to build a diverse workforce around the world. We recognize that different countries and cultures have different definitions of diversity. 3M aims to reflect the diversity of our customers, suppliers, and community partners. We foster an inclusive culture that supports and appreciates differences and provides fair and equal opportunities for everyone. We recognize the importance of equal access to science, technology, engineering, and mathematics (STEM) education and careers.

To advance our social justice and impact agenda, we created a holistic cross-functional team to support our goals and commitments to progress equity in our workplaces, business practices, and communities globally. We also support our values with an internal CEO Inclusion Council, chaired by CEO Mike Roman, to advance diversity, equity, and inclusion initiatives. In 2023, we defined our environmental justice ambition to “deliver on our company promise by leveraging our expertise and capabilities alongside community leaders to help solve some of the most pressing environmental justice challenges facing our 3M communities.” We made steady progress throughout 2023, working to weave a focus on environmental justice into key business processes and policies, as well as to define environmental justice principles. We acted on those principles by increasing site engagement with the local community at three prioritized locations. Using a proven methodology of “listen, understand, act,” we held listening sessions to understand the community’s needs, then identified opportunities to share insights and collaborate with local businesses and officials to make meaningful impact.

In 2023 we prepared for the spin-off of our Health Care business and the emergence of two world-class public companies poised for growth. In this transformational moment, the foundation we build going forward will be critically important. For the future of 3M, for the future of our planet, and for future generations, we must continually reimagine what’s possible.

As we build on our global capabilities and diverse technologies, we have clear commitments and bold ambitions to shape a sustainable future within our Strategic Sustainability Framework and its three organizing pillars: Science for Circular, Science for Climate, and Science for Community.

| | | | | | | | | | | |

| | | |

| | | |

Science for Circular | We see the circular economy as an opportunity to create impactful solutions, inspire leadership, and implement disruptive change across all industries. 3M, in partnership with GlobalGiving, collaborates with Plastic Bank to support ethical collection of plastic waste in Brazil. 2023 saw the completion of a two-year collaboration that helped stop 801,680 pounds of plastic — the equivalent of over 18 million 500 ml plastic bottles — from entering the ocean. 3M was one of the first of over 200 global businesses, financial institutions, and NGOs that have endorsed the Business Coalition for a Global Plastics Treaty, a common vision that will guide policy engagements with governments to end plastic pollution and accelerate progress toward a circular economy. As a member of the Water Resilience Coalition leadership committee, 3M participated in key events in 2023, including a workshop the coalition held at 3M Stockholm during World Water Week on the ambition of net positive water impact, as well as the first pilot program. The Water Resilience Coalition also held a workshop at 3M headquarters on how to scale basinwide collective action at 100 priority basins worldwide. Since 2019, 100 percent of 3M projects entering the new product commercialization process include features or functions that drive sustainability impact, such as an environmental or social challenge like improving air quality, reducing GHG emissions, or improving patient and worker safety. |

| | | |

| | | |

Science for Climate | We’re advancing our impact through intermediate and long-term goals and actions that align with the latest findings by the Intergovernmental Panel on Climate Change (IPCC). In 2023, our efforts yielded a significant emissions reduction — more than 20 percent — in scope 3, category 4 (upstream transportation and distribution). During Climate Week NYC, 3M highlighted new developments in key areas of climate innovation, including direct air capture (DAC) technology, and convened stakeholders from across industries to discuss how material science can accelerate climate solutions. 3M is in a three-year partnership with the United Nations Framework Convention on Climate Change. This collaboration helps us highlight technology and solutions that inspire movement on climate commitments, including engagements at COP28. Along with our partner Earthworm Foundation, we’re supporting the Tsay Keh Dene (TKD) First Nation in British Columbia, Canada, to protect high conservation value forests in their territory. As some of the world’s last remaining intact forests, they serve as sources of sustenance, culture, and history for the TKD, as well as critical species habitat and carbon storage. Using data science, we’re enhancing capabilities to estimate our products’ carbon footprint and identify opportunities for reduction. Leveraging science and technology, we‘re reducing emissions in our operations while improving the design and manufacture of our products for sustainability. We estimate an avoidance of 135 metric tons of carbon dioxide (CO2) for our customers through the use of select 3M product platforms over the past seven years. |

| | | |

| | | |

Science for Community | We recognize the importance of cultivating a connected community. In 2023, 3M continued to work toward our goal to invest $50 million to address racial opportunity gaps in the U.S. through workforce development and STEM education initiatives. Contributions for 2023 totaled $13.1 million. Our efforts were recognized by the 2023 Racial Equity Dividends Index, which named 3M a high-scoring business for four out of seven categories, including Philanthropy & Investment. In November, 3M hosted 70 participants at the first 3M Environmental Justice Summit — one of the first times a corporation brought together private companies, public entities, and community organizations to share insight and perspective on the topic. 3M supports education initiatives that advance equitable outcomes in STEM for underrepresented students globally. Since 2021, we’ve supported over 2 million unique STEM and skilled trades learning experiences, on track with our commitment to create 5 million experiences by end of the 2025-26 school year. In 2023 we opened a new 15,000-square-foot automotive training facility in St. Paul, Minnesota, dedicated to educating and upskilling technicians on the most up-to-date automotive collision repair and refinishing processes. |

| |

| | | | | | | | | | | | | | |

| | | |

| Ratification of the appointment of independent registered public accounting firm for 2024 (page 61) •Ratify the appointment of PricewaterhouseCoopers LLP (PwC) as 3M’s independent registered public accounting firm for 2024. •Based on its assessment of the qualifications and performance of PwC, the Audit Committee believes that it is in the best interests of the Company and its shareholders to retain PwC. | |

| |

| | “FOR” | |

Executive compensation

| | | | | | | | | | | | | | |

| | | |

| Advisory approval of executive compensation (page 66) •Approve, on an advisory basis, the compensation of our Named Executive Officers. •Our executive compensation program appropriately aligns our executives’ compensation with the performance of the Company and its business units as well as their individual performance. | |

| |

| | “FOR” | |

We are building momentum and a foundation for future growth

In 2023, we focused on building momentum and improved operational performance to position 3M for a bright future. Our team executed our strategic priorities, while we delivered for customers, exceeded earnings and cash flow expectations, and exited the year stronger, leaner, and more focused. We managed dynamic external environments as we prioritized investments in attractive markets, applying our material science expertise to meet customer needs across our core and new platforms, including automotive electrification, climate technology, and industrial automation. We also made significant progress simplifying our supply chain, restructuring our organization, advancing the spin-off of our Health Care business, and reducing risk and uncertainty by proactively and effectively managing litigation. We have clear strategic priorities to capitalize on our strong cash flow generation as we work to unlock value for customers and shareholders, both today and into the future.

We are preparing to spin off our Health Care business to create two world-class public companies

The spin-off of the Health Care business is on track to be completed on April 1, 2024. As a standalone health care business with a diverse portfolio of trusted brands, the spin-off Health Care business called Solventum Corporation (“Solventum”) will be better positioned to deliver industry-leading innovation for millions of patients worldwide. As we began building out the executive team for Solventum, we appointed Bryan Hanson as CEO of the Health Care Business Group in September 2023. With his unique qualifications and proven executive track record of successfully leading, growing and transforming global medical device businesses, we are confident Mr. Hanson is the right leader for the new company to ensure its success for customers, patients, and shareholders.

Compensation program supports our talent and value creation strategy

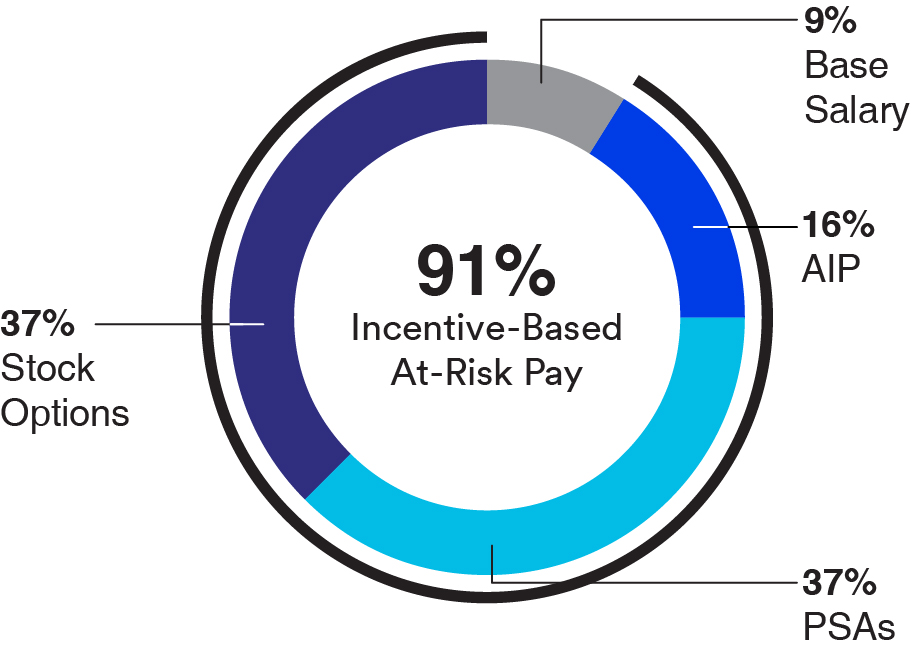

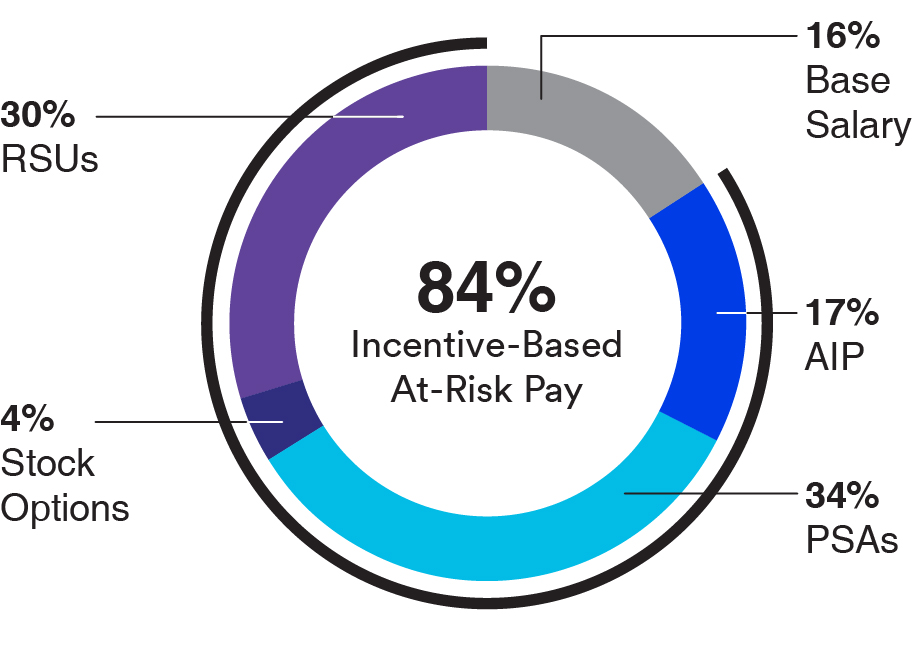

To enable our progress and continued momentum, we are deliberately prioritizing our talent and compensation strategy to encourage the contributions of a high-caliber executive leadership team. In 2023, we set the target compensation levels for the majority of our executive officers at or near the peer group median. To align pay outcomes with the long-term interests of our shareholders, over 91 percent of our CEO’s target pay and on average 84 percent of other NEOs’ target opportunities were provided in the form of at-risk variable incentives that deliver value only if we achieve pre-set performance goals or increase or decrease in value consistent with 3M’s total shareholder return or, in the case of stock options, the value of 3M’s common stock. Only in select circumstances did compensation packages reflect expanded pay benchmarks and did we utilize special incentives to support our ability to attract and retain individual skillsets and incentivize critical contributions during a pivotal transformation period. Our short- and long-term performance metrics reflect our growth drivers and were further refined for 2024 to incorporate shareholder feedback and to enhance focus on cash flow, a key driver of value for 3M, and comprehensive sustainability priorities that are important for our future.

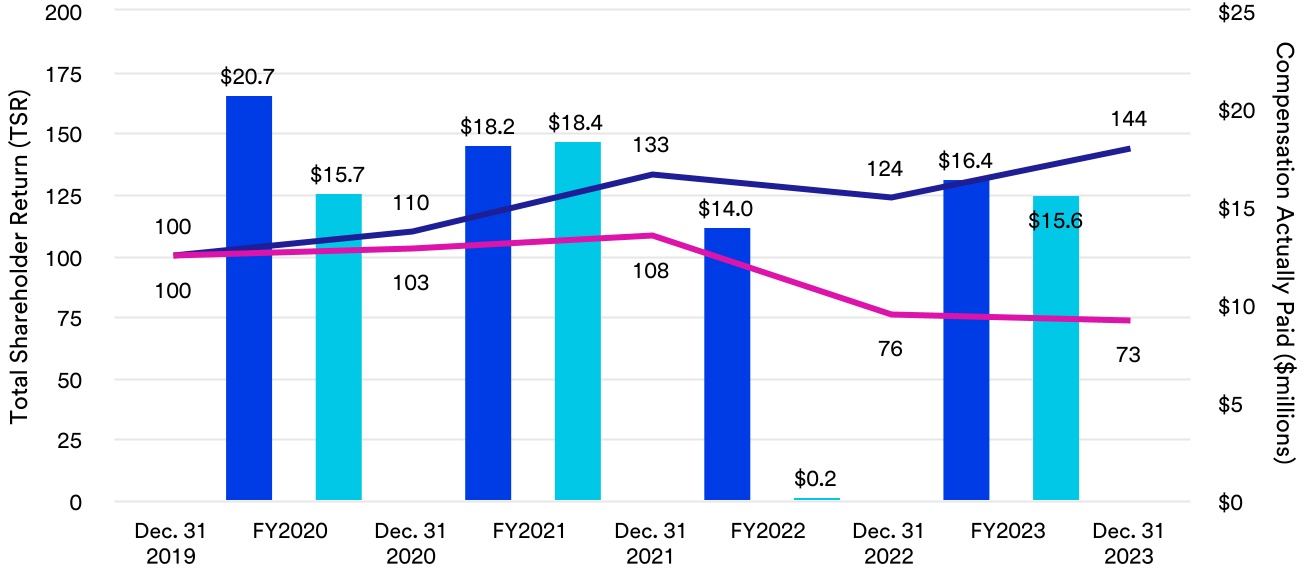

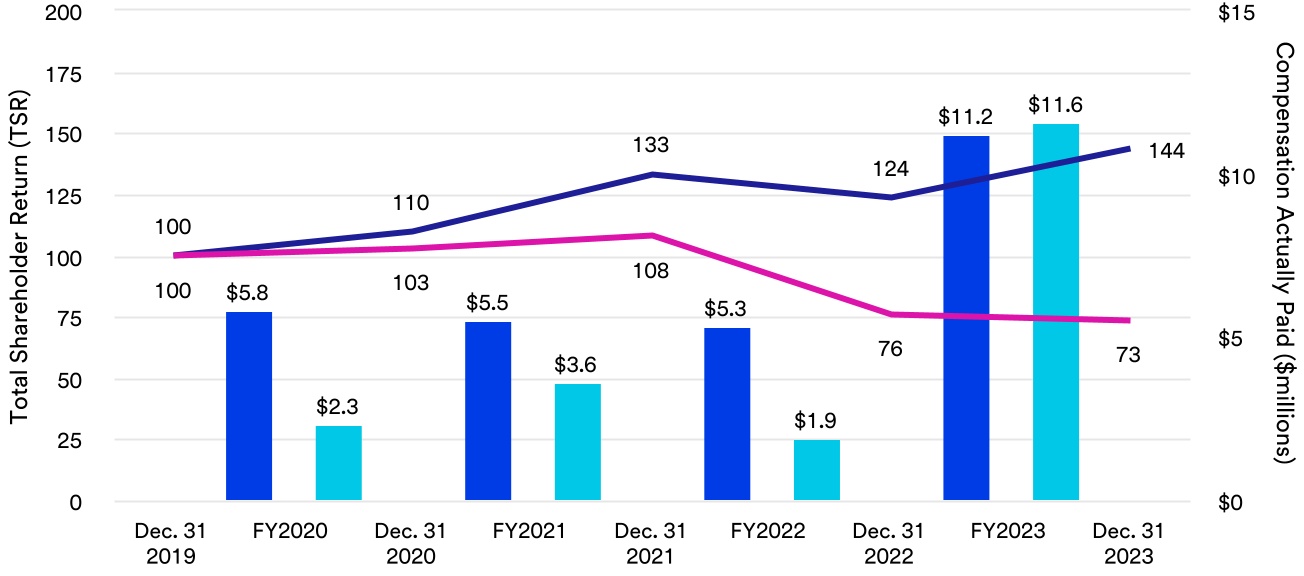

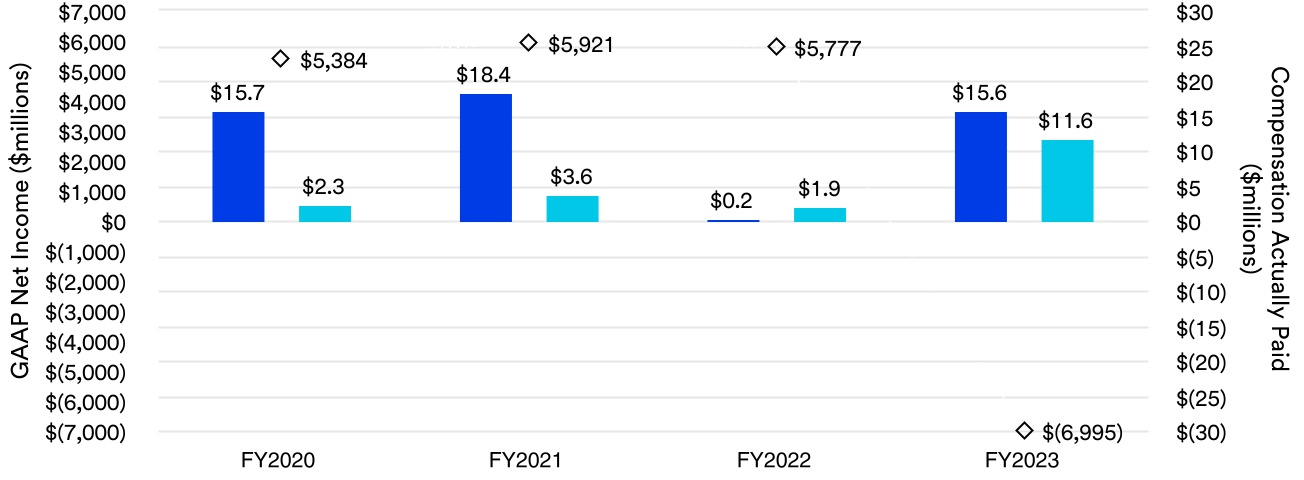

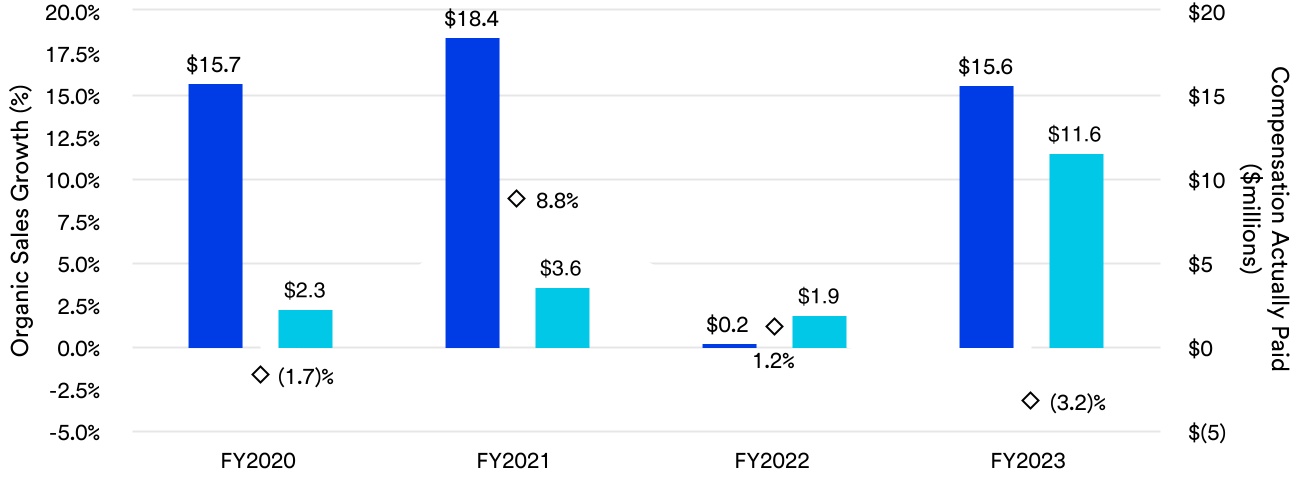

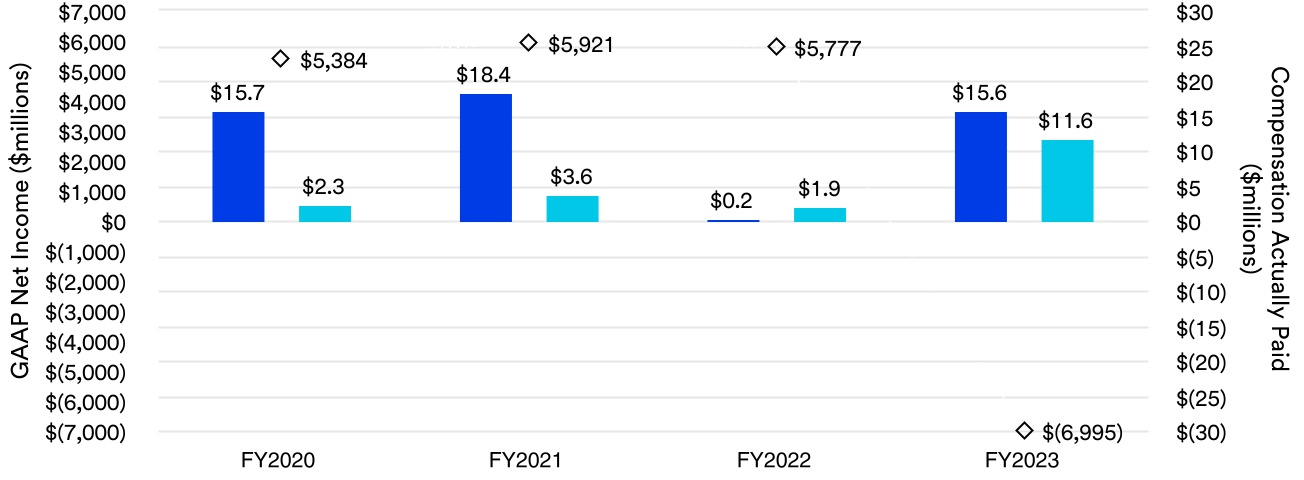

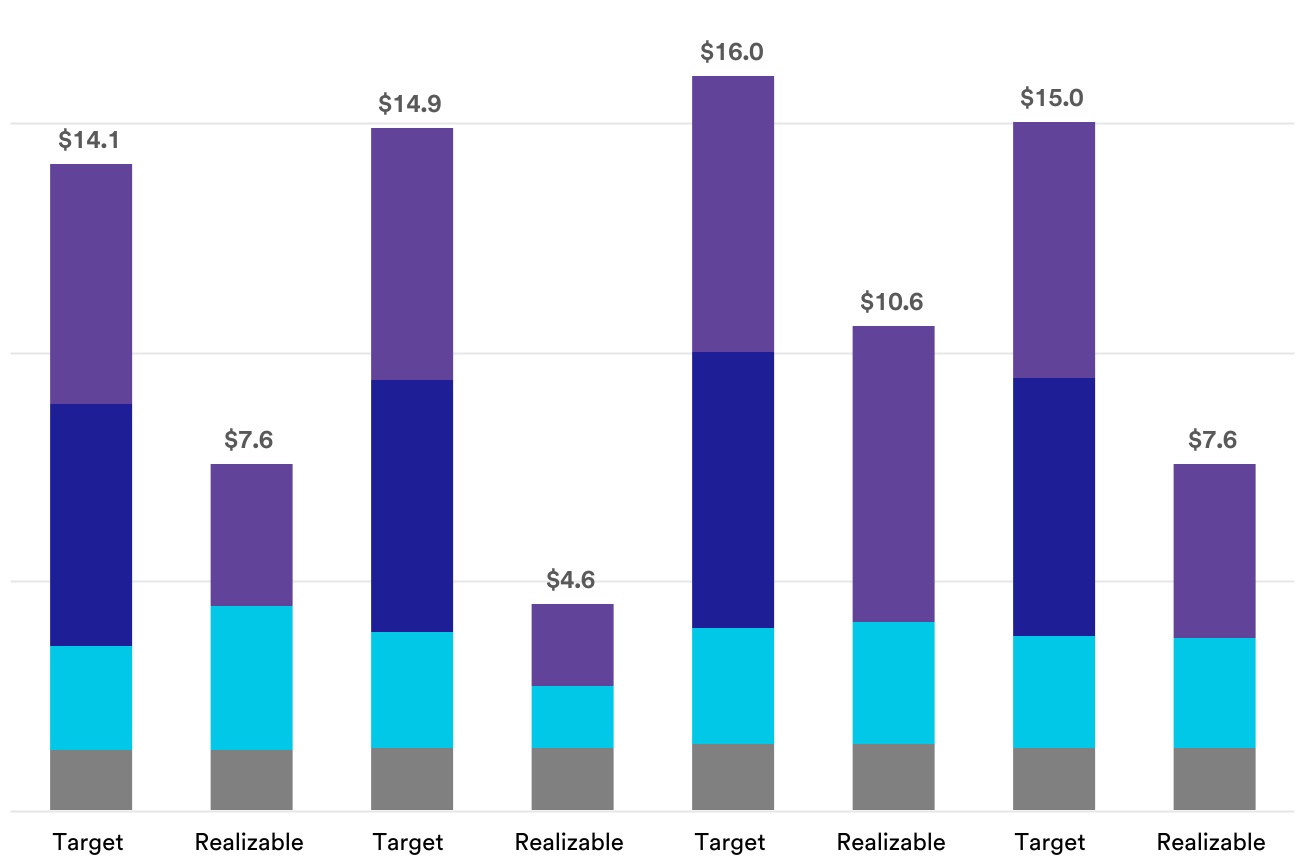

Executive compensation program aligned with shareholders

Our total shareholder return for the year reflected significant external uncertainties, including rapid declines in consumer-facing markets such as electronics and consumer retail, slowing growth in China, and mixed demand across industrial markets. Consistent with our shareholder experience, the realizable compensation in 2023 for our CEO was 66 percent of target pay, underscoring the overall alignment of pay outcomes with outcomes for our shareholders. Three-year average realizable compensation for our CEO was 51 percent of target, consistent with longer-term shareholder returns.

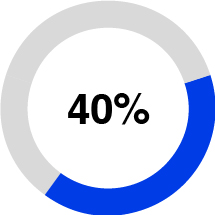

•The short-term incentive program paid out at 104.0 percent of target for our CEO and between 85.5 percent and 124.8 percent of target for our other Named Executive Officers. These payouts reflected particularly strong performance on Free Cash Flow Conversion driven by our actions to streamline our supply chains and our ongoing focus on working capital management, especially inventory, and above target performance on Operating Income, which was partially offset by below-target performance on Local Currency Sales; and

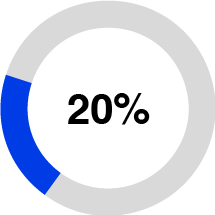

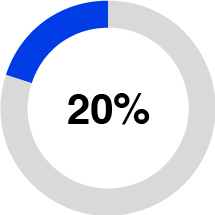

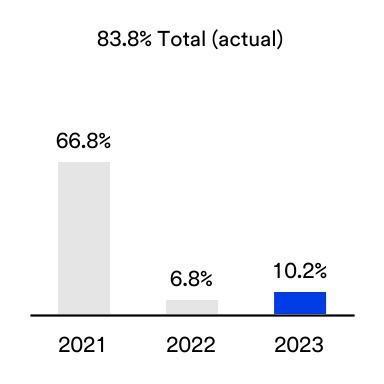

•The long-term performance shares for the 2021-2023 performance period were earned at 83.8 percent of target, which represented 59.7 percent of the initial target grant value after considering the change in market value of 3M’s common stock over the performance period and accounting for the dividend equivalents associated with earned performance shares.

We continue to act with urgency as we support our mission to innovate, reimagine what is possible, and deliver value to our shareholders and the broader communities that we serve.

Recent business accomplishments

Below are a few noteworthy accomplishments from January 1, 2023, through March 1, 2024.

| | | | | | | | | | | |

| | | |

Driving performance through the 3M model | •Delivered on 2023 commitments with results that exceeded our original earnings and cash flow guidance as we strengthened operational performance, implemented significant restructuring actions, and simplified our supply chains, while prioritizing growth opportunities •Drove Adjusted Earnings per Share of $9.84 and significantly increased Free Cash Flow 30% year-on-year to $6.3 billion, with robust conversion of 123%, up 37 ppts year-on-year* •Invested $3.5 billion in research and development and capital expenditures to position 3M for the future, including investments focused on growth, productivity, and sustainability •Focused on using material science to make a difference in the world. Advanced solutions that helped drive 30% revenue growth in our automotive electrification program in 2023 •Returned $3.3 billion to shareholders in 2023 via dividends; over 105 consecutive years of paying dividends to shareholders |

| | | |

| | | |

Portfolio optimization | •Progressed the spin-off of our Health Care business; spin-off on track for April 1, 2024 •Continued building 3M for the future, prioritizing high growth markets like automotive electrification, personal safety, home improvement, and consumer electronics. We are also investing in large emerging markets that demand our material science innovation, including climate technology, industrial automation, and next-generation electronics •Prioritizing our product portfolios based on market potential, right to win, supply chain complexity, margins, and returns •Following through on sustainability commitments: investing $1 billion over 20 years to accelerate progress on our air and water stewardship priorities and plastics reduction goals |

| | | |

| | | |

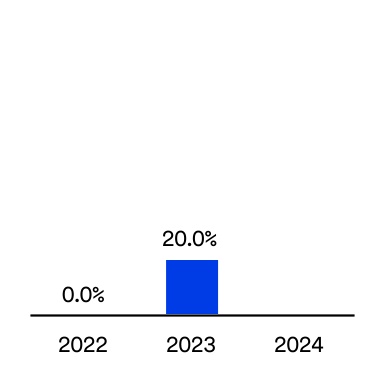

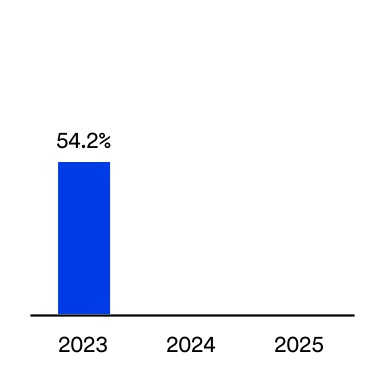

Reducing risk and uncertainty | •Reduced risk and uncertainty by proactively and effectively managing litigation •Entered into a settlement with U.S. Public Water Suppliers in PFAS litigation, providing funding for treatment of drinking water across the country, which received preliminary approval by the court and is awaiting final approval •Entered into a settlement of the Combat Arms Earplugs litigation intended to provide certainty and finality, which has received strong support from all parties and the Court as we have successfully completed each milestone toward full implementation of the settlement agreement •Remain on schedule to exit all PFAS manufacturing by the end of 2025, with 2023 production volumes down 20% |

| | | | | | | | |

| | |

| * See Appendix A to this Proxy Statement for a reconciliation of these “non-GAAP” financial measures to the most directly comparable financial measures as determined in accordance with generally accepted accounting principles in the United States (GAAP). As explained in Appendix A, all non-GAAP financial measures presented in the “Compensation Discussion and Analysis” section are used for compensation purposes and include the adjustment of certain special items that the Compensation and Talent Committee believes are outside the control of management and are not reflective of ongoing operations. The non-GAAP financial measures used herein may not be comparable to similarly titled measures used by other companies and the adjusted amounts used for compensation purposes may differ from the adjusted amounts used by the Company elsewhere or included in the Company’s Form 10-K. |

| | |

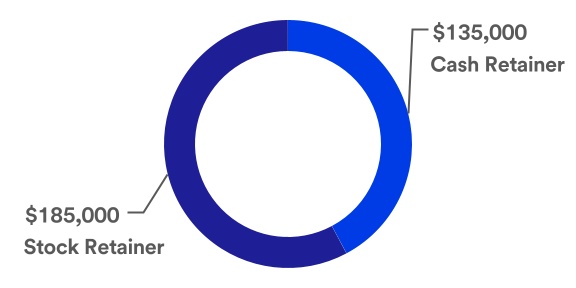

Elements of 2023 target total direct compensation

The table below shows how the 2023 target Total Direct Compensation of the Named Executive Officers was apportioned among base salary, annual incentives, performance share awards, stock options, and restricted stock units (RSUs), summarizes the rationale for providing and key characteristics of each such element, and lists the performance metrics, weightings, and modifiers used for annual and long-term incentives granted in 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | CEO(1) | Other NEOs(1) | Why it is provided | Performance metrics, weightings, and modifiers(2) |

| | | | | |

| | | | | | | | | |

| | | | | | | | •Compensate executives for their normal day-to-day responsibilities | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | •Motivate executives to stay focused on day-to-day operations by aligning a significant portion of Total Cash Compensation with the near-term financial performance of the Company and its business units | •Local Currency Sales (of 3M or a business unit, as applicable) vs. Plan (weighted 50%) •Operating Income (of 3M or a business unit, as applicable) vs. Plan (weighted 30%) •3M Operating Cash Flow Conversion vs. Plan (weighted 20%) •Individual performance multiplier (± 20%) •ESG modifier (± 10% of target) |

| | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | Performance Shares | •Motivate executives to focus on continuously improving performance in key financial metrics believed to drive long-term shareholder value •Retain executive talent | •Adjusted Earnings per Share Growth (33.3%) •Free Cash Flow Growth (33.3%) •Relative Organic Sales Growth (33.3%) |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | Stock Options(3) | •Motivate executives to build long-term shareholder value •Retain executive talent | •Vesting is based on continued service, while value of the options is based on stock price appreciation (100%) |

| | | | | |

| | | | | | | |

| | | | | | | |

| | | | Restricted Stock Units(3) | •Motivate executives to build long-term shareholder value •Retain executive talent | •Vesting is based on continued service, while value of the RSUs is based on total shareholder return (100%) |

| | | | | |

(1)Percentages shown reflect the apportionment (or, in the case of the percentages shown for the Other NEOs, the average apportionment) of the components of target total direct compensation that are expected to be recurring. Such amounts do not reflect special items such as hiring bonuses, one-time make-whole and inducement awards granted in connection with the commencement of employment, or special grants.

(2)In determining the level of achievement of the performance goals established under the AIP and the performance share awards for any given period, the costs, sales and impact on assets and liabilities from acquisitions are excluded in the year that the acquisition is completed. The Compensation and Talent Committee also makes other adjustments from time to time for special items that it believes are unrelated to the operational performance of the Company for the relevant measurement period (e.g., changes in tax laws or accounting principles, asset write-downs, the impact of restructurings, divestitures, or asset sales, unusual tax transactions, litigation or claim judgments and settlements, and other special items described in management’s discussion and analysis of financial condition and results of operations appearing in the Company’s annual/quarterly report to shareholders for the applicable period). These adjustments can have either a positive or negative impact on award payouts.

(3)For the Company’s CEO, the Compensation and Talent Committee chose to deliver 50 percent of the target grant value of his 2023 annual long-term incentive awards in the form of performance shares and the remaining 50 percent in the form of stock options. Each of the Company’s other executives was given an opportunity to indicate a preference to receive 50 percent of the target grant value of their annual long-term incentive awards in the form of RSUs, stock options, or an equal split of both stock options and RSUs. Regardless of an executive’s indicated preference, the remaining 50 percent of the target grant value of his or her 2023 annual long-term incentive awards was delivered in the form of performance shares. The percentages shown reflect the apportionment of stock options and RSUs based on the Named Executive Officers’ 2023 elections (other than our CEO, who was not offered an opportunity to make an election).

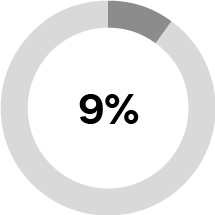

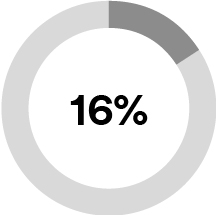

Say-on-pay results

3M has a history of strong say-on-pay results. In 2023, approximately 88 percent of the votes cast on our say-on-pay proposal approved the compensation of our named executive officers as disclosed in last year’s Proxy Statement. Based on this level of support and the generally positive feedback received from shareholders during our 2023 investor outreach and engagement efforts, we did not make significant changes to our executive compensation program in 2023. As it has in past years, the Compensation and Talent Committee will consider the results of this year’s say-on-pay proposal, as well as feedback from our shareholders, when making future executive compensation decisions.

For information concerning our investor outreach efforts, see “Shareholder outreach and engagement” on page 11. Recent noteworthy compensation program actions

Since January 1, 2023, the Board and the Compensation and Talent Committee took the following noteworthy actions:

•Appointed Bryan C. Hanson as Group President and Chief Executive Officer, Health Care and approved his initial compensation arrangements. For more information, see “Section V: 2023 compensation decisions and performance highlights — Bryan C. Hanson — Compensation Decisions” on page 98. •Amended the 3M Executive Severance Plan to provide for pro rata vesting of inducement restricted stock unit awards based on whole years of completed service.

•Significantly expanded the population of employees subject to our clawback policy with approximately 350 employees at the Vice President level and above now subject to recoupment based on the issuance of noncompliant financial reports, significant misconduct, or a significant risk-management failure. Made other revisions in line with new regulatory guidance implemented by the NYSE, including the expanded definition of an accounting restatement to cover so-called “little r” restatements. For more information, see “Clawback policy and other remedial actions” on page 102. •Effective for the 2024 annual incentive compensation program offered to eligible employees, updated the metrics and weightings with the intent of enhancing focus on cash flow growth, a key driver of value for 3M. For more information, see “2024 changes to our annual incentive compensation program” on page 87. •Approved various actions related to the Company’s U.S. retirement plans, including a future pension “freeze” for non-union employees, effective December 31, 2028, and a supplemental three percent annual Company retirement contribution to the 401(k) plan accounts of eligible employees impacted by the future pension plan freeze, effective January 1, 2029.

| | | | | | | | | | | | | | |

| | | |

| •Shareholder proposal, if properly presented at the meeting. •See Board’s opposition statement. | |

| |

| | “AGAINST” | |

| | | | | | | | | | | | | | |

| | | |

| Elect the 12 director nominees identified in this Proxy Statement •Elect the 12 director nominees identified in this Proxy Statement, each for a term of one year. •Our nominees are distinguished leaders who bring a mix of skills and qualifications to the Board and can represent the interests of all shareholders. | |

| |

| | “FOR” each nominee to the Board | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Thomas “Tony” K. Brown, 68 Retired Group Vice President, Global Purchasing, Ford Motor Company A  | | | | William M. Brown, 61* Former Chairman of the Board and Chief Executive Officer, L3Harris Technologies, and Chief Executive Officer of 3M Company (effective May 1, 2024) | | | | Audrey Choi, 56 Retired Chief Sustainability Officer and Chief Marketing Officer, Morgan Stanley N&G STS |

| | | | |

| | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Anne H. Chow, 57** Retired Chief Executive Officer, AT&T Business C&T STS | | | | David B. Dillon, 72 Retired Chairman of the Board and Chief Executive Officer, The Kroger Co.  N&G N&G | | | | James R.

Fitterling, 62** Lead Independent Director Chair of the Board and Chief Executive Officer, Dow Inc. |

| | | | |

| | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Amy E. Hood, 52 Executive Vice President and Chief Financial Officer, Microsoft Corporation C&T STS | | | | Suzan Kereere, 58 President, Global Markets, PayPal, Inc. A C&T | | | | Gregory R. Page, 72 Retired Chairman of the Board and Chief Executive Officer, Cargill C&T  |

| | | | |

| | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Pedro J. Pizarro, 58 President and Chief Executive Officer and Director, Edison International

A N&G | | | | Michael F. Roman, 64* Chairman of the Board and Chief Executive Officer, 3M Company | | | | Thomas W. Sweet, 64 Retired Chief Financial Officer, Dell Technologies A N&G |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Key | | | | | | | |

| Independent | | C&T | Compensation and Talent | | STS | Science, Technology & Sustainability |

A | Audit | | N&G | Nominating and Governance | | | Chair |

* Effective May 1, 2024, Mr. William M. Brown will become Chief Executive Officer of 3M, and Mr. Roman will become Executive Chairman of the Board.

** Effective April 3, 2024, Mr. Fitterling will assume the duties of Lead Independent Director and Ms. Chow will assume the role of C&T Chair.

| | | | | |

Corporate governance at 3M |

| |

At the 2024 Annual Meeting, 12 directors are to be elected to hold office until the 2025 Annual Meeting of Shareholders and until their successors have been elected and qualified. Except as noted below, all nominees are presently 3M directors who were elected by shareholders at the 2023 Annual Meeting. Ms. Audrey Choi, who joined the board on August 9, 2023, and Mr. Thomas W. Sweet, who joined the board on November 6, 2023, are each standing for election for the first time. A director search firm assisted with the identification of Ms. Choi and Mr. Sweet for recommendation by the Nominating and Governance Committee for their election to the Board.

In addition, on March 8, 2024, the 3M Board appointed Mr. William M. Brown Chief Executive Officer of 3M, effective May 1, 2024, succeeding Mr. Michael F. Roman, and Mr. Brown is also standing for election to the 3M Board for the first time. An executive search firm assisted with the identification of Mr. Brown for his election to the Board. Concurrent with the appointment of Mr. Brown as Chief Executive Officer, on March 8, 2024, the 3M Board appointed Mr. Roman as Executive Chairman of the 3M Board, effective May 1, 2024.

Mr. Michael L. Eskew, who has served as our Lead Independent Director since 2012, will retire from his service on the 3M Board on May 14, 2024, when his term expires, pursuant to 3M’s mandatory director retirement age policy. We thank Mr. Eskew for his leadership and his many contributions to the Board and to the Company. Mr. James R. Fitterling, who has served on 3M’s Board since 2021, including as the Chair of the Compensation and Talent Committee of the Board, will assume the role of Lead Independent Director effective April 3, 2024. In addition, the Board has appointed Ms. Chow as the Chair of the Compensation and Talent Committee of the Board effective April 3, 2024.

No additional director replacements are being announced at this time. The Company will continue to refresh its Board of Directors regularly with the skills and experiences deemed most critical for setting strategic objectives and positioning 3M to drive long-term shareholder value.

We expect each nominee for election as a director to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board chooses to reduce the number of directors serving on the Board. Each nominee elected as a director will continue in office until his or her successor has been elected and qualified, or until his or her earlier death, resignation, or retirement.

The Nominating and Governance Committee reviewed the Board Membership Criteria (described on page 34) and the specific experience, qualifications, attributes, and skills of each nominee, including membership(s) on the boards of directors of other public companies. The following pages contain biographical and other information about the nominees. Following each nominee’s biographical information, we have provided information concerning the particular experience, qualifications, attributes, and skills that are deemed most critical to 3M’s long-term success and led the Nominating and Governance Committee and the Board to determine that each nominee should serve as a director. In addition, the majority of our directors serve or have served on boards and board committees (including as committee chairs) of other public companies, which the Board believes provides them with additional board leadership and governance experience, exposure to best practices, and substantial knowledge and skills that further enhance the functioning of our Board.

| | | | | |

| Corporate governance at 3M |

| |

Nominees for director

| | | | | | | | | | | | | | |

| | | | |

| Thomas “Tony” K. Brown 68 Independent Retired Group Vice President, Global Purchasing, Ford Motor Company | Director since 2013 |

| | | | |

Professional Highlights Mr. Brown is the Retired Group Vice President, Global Purchasing, Ford Motor Company, a global automotive industry leader. Mr. Brown served in various leadership capacities in global purchasing since joining Ford in 1999. In 2008, he became Ford’s Group Vice President, Global Purchasing, with responsibility for approximately $90 billion of production and non-production procurement for Ford operations worldwide. He retired from Ford on August 1, 2013. Prior to Ford, from 1997 to 1999 he served in leadership positions at United Technologies Corporation, including its Vice President, Supply Management. From 1991 to 1997 he served as Executive Director, Purchasing and Transportation at QMS Inc. From 1976 to 1991 he served in various managerial roles at Digital Equipment Corporation. Nominee Qualifications Mr. Brown’s bachelor’s degree in business administration from American International College in Springfield, Massachusetts, his leadership roles, including his experience serving as a director of the public companies listed, and his knowledge of and extensive experiences in global purchasing, management, and supply chain at Ford Motor Company and other companies, qualify him to serve as a director of 3M. | Other current directorships •ConAgra Foods, Inc. 3M Board committee(s) •Audit •Nominating and Governance (Chair) Directorships within the past five years •Tower International, Inc. |

| | | | | |

Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| William M. Brown 61 Former Chairman of the Board and Chief Executive Officer, L3Harris Technologies | Director since New nominee |

| | | | |

Professional Highlights Mr. Brown is the former Chairman of the Board and Chief Executive Officer of L3Harris Technologies, a global innovator in aerospace and defense technology solutions, where he served as Executive Chair from June 2021 to June 2022, after having served as Chairman and Chief Executive Officer from June 2019 to June 2021. Mr. Brown previously served as Chairman, President and Chief Executive Officer of Harris Corporation prior to its merger with L3 Technologies in 2019. He joined Harris Corporation in November 2011 as President and Chief Executive Officer and was appointed Chairman in April 2014. Prior to Harris Corporation, Mr. Brown spent 14 years at United Technologies Corporation serving in a variety of leadership roles. On March 8, 2024, the 3M Board of Directors appointed Mr. Brown Chief Executive Officer of 3M Company, effective May 1, 2024, succeeding Mr. Roman, who is being appointed to a newly created position, Executive Chairman of the 3M Board, also effective May 1, 2024. Nominee Qualifications Mr. Brown’s bachelor’s and master’s degrees in mechanical engineering from Villanova University and an MBA degree from The Wharton School, University of Pennsylvania, his wealth of strategic leadership, innovation, operational excellence, cybersecurity, and leadership experience as a public company chief executive officer for 13 years of complex global organizations, along with his strong corporate governance background and experience in the U.S. and international business, and his service on other public company boards, qualify him to serve as a director of 3M. | Other current directorships •Becton, Dickinson and Company •Celanese Corporation* Directorships within the past five years •L3Harris Technologies, Inc. •Harris Corporation (until merger with L3 Technologies in 2019) |

* Mr. Brown will not stand for re-election as a director at the annual shareholder meeting of Celanese Corporation scheduled to be held on May 13, 2024 and will serve on the Celanese board until Celanese’s 2024 annual shareholder meeting.

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Audrey Choi 56 Independent Retired Chief Sustainability Officer and Chief Marketing Officer, Morgan Stanley | Director since 2023 |

| | | | |

Professional Highlights Ms. Choi is the Retired Chief Sustainability Officer and Chief Marketing Officer, Morgan Stanley, a global financial services firm with offices in 41 countries. Ms. Choi was Morgan Stanley’s first Chief Sustainability Officer and a member of its Global Management Committee from 2017-2022. She was also Chief Marketing Officer from 2017-2021. Over the course of her 16-year career at Morgan Stanley, she founded and led the Global Sustainable Finance Group, the Institute for Sustainable Investing and the Community Development Finance Group. During Ms. Choi’s public service career, she served in senior policy positions in the Clinton Administration including Chief of Staff of the Council of Economic Advisers in the White House. Prior to her government service, she was a foreign correspondent and bureau chief for The Wall Street Journal in Europe. Ms. Choi has a long record of service in the philanthropic and non-profit sector including as a board member of the Sustainable Accounting Standards Board (SASB), Wildlife Conservation Society, StoryCorps, Local Initiatives Support Corporation, New York Cares, the Impact Investing Alliance, and the Kresge Foundation. Nominee Qualifications Ms. Choi’s MBA from Harvard Business School and A.B. from Harvard College, her executive leadership roles and experience at Morgan Stanley, especially in sustainability and marketing, and her other board positions, qualify her to serve as a director of 3M. | Other current directorships •None 3M Board committee(s) •Nominating and Governance •Science, Technology & Sustainability |

| | | | | |

Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Anne H. Chow 57 Independent Retired Chief Executive Officer, AT&T Business | Director since 2023 |

| | | | |

Professional Highlights Ms. Chow is the Retired Chief Executive Officer of AT&T Business, which provides solutions to businesses across all industries as well as the public sector. She is also the founder and CEO of The Rewired CEO, a business service firm, and is a Senior Fellow and Adjunct Professor of Executive Education at the Kellogg School of Management, Northwestern University. Ms. Chow served as the CEO of AT&T Business from 2019 to 2022 after having served in various executive leadership positions at AT&T since 2000, including President — National Business, President — Integrator Solutions, and Senior Vice President — Premier Client Group. At AT&T Business, Ms. Chow was responsible for nearly 3 million business customers in more than 200 countries and territories around the world, including nearly all the world’s Fortune 1000 companies. Her responsibilities encompassed AT&T’s full suite of business services across wireless, networking, cybersecurity, and advanced solutions, covering more than $35 billion in revenues with an organization of over 35,000 people. She has a long track record of community leadership involvement in board and advisory roles at organizations such as the Girl Scouts of the USA, New Jersey Chamber of Commerce, and the Asian American Justice Center. Reflective of her impact in driving success at the intersection of people, culture, and technology, Ms. Chow was named to Fortune’s Most Powerful Women in Business twice, Forbes inaugural CEO Next List of Leaders set to revolutionize American business, and recognized with Linkage’s Legends in Leadership Award. Nominee Qualifications Ms. Chow’s master’s degree in business administration from Cornell University, her bachelor’s and master’s degrees in electrical engineering from Cornell University, her decades of executive leadership positions at AT&T, including as CEO of AT&T Business, and her extensive global and cross-functional experience in management, technology, cybersecurity, marketing and sales, operations, strategy, business and culture transformation, finance, and ESG matters, as well as her experience as a director at another public company, qualify her to serve as a director of 3M. | Other current directorships •Franklin Covey Co. (lead independent director) 3M Board committee(s) •Compensation and Talent* •Science, Technology & Sustainability |

* Effective April 3, 2024, Ms. Chow will assume the role of Compensation and Talent Committee Chair.

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| David B. Dillon 72 Independent Retired Chairman of the Board and Chief Executive Officer, The Kroger Co. | Director since 2015 |

| | | | |

Professional Highlights Mr. Dillon is the Retired Chairman of the Board and Chief Executive Officer, The Kroger Co., a large retailer that operates retail food and drug stores, multi-department stores, jewelry stores, and food production facilities throughout the U.S. Mr. Dillon retired on December 31, 2014 as Chairman of the Board of Kroger, where he was Chairman since 2004 and was the Chief Executive Officer from 2003 through 2013. Mr. Dillon served as President of Kroger from 1995 to 2003 and was elected Executive Vice President in 1990. Mr. Dillon served as Director of The Kroger Co. from 1995 through 2014. Mr. Dillon began his retailing career at Dillon Companies, Inc. (later a subsidiary of The Kroger Co.) in 1976 and advanced through various management positions, including its President from 1986-1995. Nominee Qualifications Mr. Dillon’s bachelor’s degree in business from the University of Kansas and his law degree from Southern Methodist University, his leadership roles and experiences at The Kroger Co., including serving as Chairman of the Board and Chief Executive Officer, his knowledge of and extensive experiences in leading one of the world’s largest retailers, his experiences in Kroger’s successful $13 billion merger with Fred Meyer, Inc., his leadership in sustainability, his skills in financial and audit matters, and his experiences as a director at other public companies, qualify him to serve as a director of 3M. | Other current directorships •Union Pacific Corporation 3M Board committee(s) •Audit (Chair) •Nominating and Governance |

| | | | | |

Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| James R. Fitterling 62 Independent Chair of the Board and Chief Executive Officer, Dow Inc. | Director since 2021 |

| | | | |

Professional Highlights Mr. Fitterling is the Chair of the Board and Chief Executive Officer of Dow Inc., one of the world’s leading global materials science companies. Mr. Fitterling was named CEO-elect of Dow in March 2018 prior to becoming CEO in July 2018, and he was elected Chairman in April 2020. Before that, he served as President and Chief Operating Officer of Dow and also previously served as Chief Operating Officer for the Materials Science division of DowDuPont. In his 40 year career with the company, Mr. Fitterling has spent 10 years in Asia, and has held leadership positions with P&L responsibility in many of the company’s operations. A strong advocate for inclusion and diversity, Mr. Fitterling was named # 1 LGBT + Executive in 2018 on the “OUTstanding in Business” list published by Financial Times. Mr. Fitterling serves as the Chair of the Board of Directors of the National Association of Manufacturers, immediate past Chair of the Board of Directors for the American Chemistry Council, Chair of Alliance to End Plastic Waste, and a Trustee of the Committee for Economic Development. Nominee Qualifications Mr. Fitterling’s bachelor’s degree in mechanical engineering from the University of Missouri — Columbia, his extensive leadership roles and experiences at Dow, including serving as its Chairman and CEO, his many years of international business experiences, his deep understanding and appreciation of materials science and innovation, and his strong track record of advancing environmental, social and governance goals, qualify him to serve as a director of 3M. | Other current directorships •Dow Inc. 3M Board committee(s) •Compensation and Talent (Chair)* |

* Effective April 3, 2024, Mr. Fitterling will assume the duties of Lead Independent Director and Ms. Chow will assume the role of Compensation and Talent Committee Chair.

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Amy E. Hood 52 Independent Executive Vice President and Chief Financial Officer, Microsoft Corporation | Director since 2017 |

| | | | |

Professional Highlights Ms. Hood is Executive Vice President and Chief Financial Officer of Microsoft Corporation, a worldwide provider of software, services and solutions, since May 2013. Ms. Hood is responsible for leading Microsoft’s worldwide finance organization, including acquisitions, treasury activities, tax planning, accounting and reporting, and internal audit and investor relations. Prior to this role, Ms. Hood was Chief Financial Officer of Microsoft’s Business Division, responsible for the company’s productivity applications and services including Microsoft Office 365, Office, SharePoint, Exchange, Dynamics ERP and Dynamics CRM. During her time in the Business Division, Ms. Hood helped lead the transition to the company’s Office 365 service, and she was deeply involved in the strategy development and overall execution of the company’s successful acquisitions of Skype and Yammer. Ms. Hood joined Microsoft in 2002 and previously held positions in the Server and Tools Business as well as the corporate finance organization. Prior to 2002, she worked at Goldman Sachs & Co. in various investment banking and capital markets groups roles. Nominee Qualifications Ms. Hood’s bachelor’s degree in economics from Duke University and MBA from Harvard University, her extensive leadership roles and experiences at Microsoft Corporation, especially in strategic business development, finance, and digitization, qualify her to serve as a director of 3M. | Other current directorships •None 3M Board committee(s) •Compensation and Talent •Science, Technology & Sustainability |

| | | | | |

Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Suzan Kereere 58 Independent President of Global Markets, PayPal Holdings, Inc. | Director since 2022 |

| | | | |

Professional Highlights Ms. Kereere is the President of Global Markets, PayPal Holdings, Inc., a leading digital payment partner for businesses and consumers around the world, since January 2024. Prior to her current role, Ms. Kereere was the Head of Global Business Solutions, Fiserv, Inc., a global fintech and payments company with solutions for banking, global commerce, merchant acquiring, billing and payments, and point of sale, from 2021 to 2023. Ms. Kereere has held executive leadership roles in global merchant sales and acquiring at VISA, a global payments technology company, from 2016 to 2021 and in merchant services, network business, customer services, business and corporate travel, including serving as head of U.S. National Merchant Business and head of Global Network Business at American Express where she worked from 1988 to 2016. She has led businesses in Europe, Australia, Asia and North America. Ms. Kereere is a former director at Electronic Transactions Association. Ms. Kereere serves as a Board Trustee for Alvin Ailey American Dance Theater and board member at Code for America. Nominee Qualifications Ms. Kereere’s bachelor’s degree in Economics from Tufts University and MBA degree from Columbia University Business School, her decades of experience and expertise in leading payments and technology platform business at Fortune 100 companies across global business lines and regional high growth start-ups, her accomplishments in digital transformation, sales optimization, front-line customer engagement and inclusive growth, and her track record of championing for equity in the corporate space and bringing analytics to the race and inclusion discussion, qualify her to serve as a director of 3M. | Other current directorships •None 3M Board committee(s) •Audit •Compensation and Talent |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Gregory R. Page 72 Independent Retired Chairman of the Board and Chief Executive Officer, Cargill | Director since 2016 |

| | | | |

Professional Highlights Mr. Page is the Retired Chairman of the Board and Chief Executive Officer, Cargill, an international marketer, processor and distributor of agricultural, food, financial and industrial products and services. Mr. Page was named Corporate Vice President & Sector President, Financial Markets and Red Meat Group of Cargill in 1998, Corporate Executive Vice President, Financial Markets and Red Meat Group in 1999, President and Chief Operating Officer in 2000, and became Chairman of the Board and Chief Executive Officer in 2007. He served as Executive Chairman of the Board of Cargill from December 2013 until his retirement from Cargill in September 2015, and Executive Director of Cargill from September 2015 to September 2016. Mr. Page was a director and past non-executive Chair of the Board of Big Brothers Big Sisters of America until 2022. He is past President and board member of the Northern Star Council of the Boy Scouts of America. Mr. Page is a board member at Alight, a nonprofit company serving primarily refugees and displaced people and Wayne Sanderson Farms, the nation’s third largest poultry producer company that has a complete portfolio of high-quality and affordable poultry brands and products. Nominee Qualifications Mr. Page’s bachelor’s degree in economics from the University of North Dakota, his leadership roles and experiences while serving as Chairman of the Board and Chief Executive Officer at Cargill, his expertise and knowledge of financial and audit matters and corporate governance, and his experiences as a director at the public companies listed, qualify him to serve as a director of 3M. | Other current directorships •Deere & Company •Eaton Corporation plc (lead director) •Corteva Agriscience (non-executive chair) 3M Board committee(s) •Compensation and Talent •Science, Technology & Sustainability (Chair) |

| | | | | |

Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Pedro J. Pizarro 58 Independent President and Chief Executive Officer and Director

Edison International | Director since 2023 |

| | | | |

Professional Highlights Dr. Pizarro is the President and Chief Executive Officer of Edison International, the parent company of Southern California Edison (SCE), one of the nation’s largest electric utilities, since 2016. Edison International is also the parent company of Edison Energy, a portfolio of competitive businesses providing commercial and industrial customers with energy management and procurement services. Prior to that, he served as President of SCE from 2014 to 2016. From 2011 to 2014, Dr. Pizarro served as President of Edison Mission Energy, an indirect subsidiary of Edison International until the sale of its principal assets in 2014. He has held a wide range of other senior executive positions at the Edison International companies since joining in 1999, including Executive Vice President responsible for SCE’s transmission and distribution system, power procurement and generation. Dr. Pizarro previously served as Vice President and Senior Vice President of Power Procurement, and Vice President of Strategy and Business Development. Dr. Pizarro is Chair of the Edison Electric Institute, Co-Chair of the Electricity Subsector Coordinating Council, and a Trustee of the California Institute of Technology. Prior to his work at the Edison International companies, Dr. Pizarro was a senior engagement manager with McKinsey & Company. Nominee Qualifications Dr. Pizarro’ bachelor’s degree in chemistry from Harvard University, his Ph.D. in chemistry from the California Institute of Technology, his extensive leadership experiences with Edison International, including as President and Chief Executive Officer, his extensive board service, and his knowledge and experiences with leadership, risk management, technology, safety and operations, workforce management, cybersecurity, regulatory and government affairs, business resiliency, mergers and acquisitions, and strategic planning qualify him to serve as a director of 3M. | Other current directorships •Edison International 3M Board committee(s) •Audit •Nominating and Governance |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Michael F. Roman 64 Chairman of the Board and Chief Executive Officer, 3M Company | Director since 2018 |

| | | | |