0000066740DEF 14Afalseiso4217:USDxbrli:pure00000667402024-01-012024-12-31000006674042024-01-012024-12-31000006674012024-01-012024-12-31000006674052024-01-012024-12-31000006674022024-01-012024-12-31000006674062024-01-012024-12-31000006674032024-01-012024-12-31000006674072024-01-012024-12-310000066740mmm:MichaelF.RomanMember2024-01-012024-12-310000066740mmm:WilliamM.BrownMember2024-01-012024-12-3100000667402023-01-012023-12-3100000667402022-01-012022-12-3100000667402021-01-012021-12-3100000667402020-01-012020-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembermmm:WilliamM.BrownMember2024-01-012024-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMembermmm:MichaelF.RomanMember2024-01-012024-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2023-01-012023-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2022-01-012022-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2021-01-012021-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-01-012021-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2020-01-012020-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-01-012020-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000066740ecd:AggtChngPnsnValInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000066740ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

3M Company

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | |

| | | | March 26, 2025 Dear Shareholders, On behalf of the Board of Directors and our senior management team, we are pleased to invite you to attend 3M’s Annual Meeting of Shareholders on Tuesday, May 13, 2025, at 8:30 a.m. Central Daylight Time at www.virtualshareholdermeeting.com/MMM2025. The 2025 Annual Meeting will be held exclusively online to enable shareholder participation from any location. 2024 was a pivotal year for 3M as we emerged from a period of significant transformation, including substantially completing the largest restructuring program in our history, progressing management of legal matters, and spinning off our Health Care business. We are proud of our team’s work executing these programs, and the results of these efforts are beginning to be reflected in our financial results. We also increased our focus on the fundamentals and our three top priorities: driving growth, improving operational performance and effectively deploying capital. We have made solid progress and delivered strong results in 2024. Looking ahead to 2025, we are committed to continued progress on our priorities as we implement our new performance mandate and embed excellence in every part of our company. As we navigate the external environment, we will focus, as always, on relentlessly pursuing excellence in everything we do. We hope you will join us at our Annual Meeting, which is an important opportunity to vote on matters that are outlined in the accompanying Notice of Annual Meeting and Proxy Statement. Shareholders who wish to submit questions in advance of the meeting may do so by using their 16-digit control number to access www.proxyvote.com. For information on how to attend the meeting, please read “Participating in the virtual annual meeting” on page 119 of the accompanying Proxy Statement. Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. You may vote your proxy online, by telephone, or, if this Proxy Statement was mailed to you, by completing and mailing the enclosed proxy card. Please review the instructions on the proxy card or the electronic proxy material delivery notice regarding each of these voting options. Thank you for being a 3M shareholder and for your continued support. |

| | | |

| | | |

| | | |

| | |

| Sincerely, William M. Brown Chairman of the Board and Chief Executive Officer | |

| James R. Fitterling Lead Independent Director | |

| | | | | | | | | | | |

| | | |

| | Time and Date 8:30 a.m., Central Daylight Time Tuesday, May 13, 2025 | |

| | | |

| | Where Virtual only at www.virtualshareholder meeting.com/MMM2025 | |

| | | |

| | | |

| How to vote Whether or not you plan to attend the virtual meeting, please vote your proxy either by using the Internet or telephone as further explained in this Proxy Statement or by filling in, signing, dating, and promptly mailing a proxy card. | |

| | | |

| | By Telephone In the U.S. or Canada, you may vote your shares toll-free by calling 1-800-690-6903. | |

| | | |

| | By Internet You may vote your shares online at www.proxyvote.com. | |

| | | |

| | By Mail You may vote by mail by marking, dating, and signing your proxy card or voting instruction form and returning it in the postage-paid envelope. | |

| | | |

| | By Online Voting You may vote online at the virtual Annual Meeting. | |

| | | |

| | | |

Important Notice regarding the availability of proxy materials for the Annual Meeting of Shareholders to be held on May 13, 2025. The Notice of Annual Meeting, Proxy Statement, and 2024 Annual Report are available at www.proxyvote.com. Enter the 16-digit control number located in the box next to the arrow on the Notice of Internet Availability of Proxy Materials or proxy card to view these materials. THIS PROXY STATEMENT AND PROXY CARD, AND THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, ARE BEING DISTRIBUTED TO SHAREHOLDERS ON OR ABOUT MARCH 26, 2025. |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Items of business | Board

Recommendation | Page # | |

| | | | | | | |

| | | | | | | |

| 1. | Elect the 11 director nominees identified in the Proxy Statement, each for a term of one year. | | FOR | | |

| | | | |

| | | | |

| 2. | Ratify the appointment of PricewaterhouseCoopers LLP as 3M’s independent registered public accounting firm for 2025. | | FOR | | |

| | | | |

| | | | |

| 3. | Approve, on an advisory basis, the compensation of our Named Executive Officers. | | FOR | | |

| | | | |

| | | | |

| | Transact such other business as may properly come before the Annual Meeting and any adjournment or postponement. | | | | |

| | | | | | |

| | | | | | | |

Record date You are entitled to vote if you were a shareholder of record at the close of business on Tuesday, March 18, 2025. Adjournments and postponements Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. Annual report Our 2024 Annual Report, which is not part of the proxy soliciting materials, is enclosed if the proxy materials were mailed to you. The Annual Report is accessible on the Internet by visiting www.proxyvote.com, if you have received the Notice of Internet Availability of Proxy Materials, or previously consented to the electronic delivery of proxy materials. By order of the Board of Directors, Kevin H. Rhodes Executive Vice President, Chief Legal Affairs Officer and Secretary 3M Company 3M Center, St. Paul, Minnesota 55144 Attending the virtual Annual Meeting To leverage technology and to enable shareholder participation from any location, the 2025 Annual Meeting will be held exclusively online. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/MMM2025, you need to enter the 16-digit control number on your proxy card, voting instruction form, or Notice of Internet Availability you previously received. See additional instructions on page 119. We have worked to offer the same participation opportunities as were provided at the in-person portion of our past meetings. At the virtual Annual Meeting, you or your proxy holder may participate, vote, and examine a list of shareholders of record entitled to vote at the meeting by accessing www.virtualshareholdermeeting.com/MMM2025. If you wish to submit questions in advance of the virtual meeting, you may do so by using your 16-digit control number to access www.proxyvote.com. During the virtual meeting, you may type in your questions on the meeting website as well. See additional instructions on page 120. |

| | | | | | | | | | | |

| | | |

| Special Note About Forward-Looking Statements This Proxy Statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements involve risks and uncertainties that could cause results to differ materially from those projected. Please refer to the section entitled “Risk Factors” in our Forms 10-K and 10-Q. The information contained herein is as of the date of this Proxy Statement. We assume no obligation to update any forward-looking statements contained herein as a result of new information or future events or developments, except as required by law. No Incorporation By Reference This Proxy Statement includes website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein. | |

| | | |

| | | | | | | | | | | | | | |

|

|

|

|

| Elect the 11 director nominees identified in this Proxy Statement (page 14) •Elect the 11 director nominees identified in this Proxy Statement, each for a term of one year. •Our nominees are distinguished leaders who bring a mix of skills and qualifications to the Board and can represent the interests of all shareholders. •As proven leaders, our nominees are well positioned to guide 3M’s strategic directions. |

|

|

|

| | “FOR” each nominee to the Board |

|

Corporate governance dashboard

Director nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | David P. Bozeman, 56 Independent President and Chief Executive Officer and Director, C.H. Robinson Worldwide Tenure 2025 Committee STS | | | | Thomas “Tony” K. Brown, 69 Independent Retired Group Vice President, Global Purchasing, Ford Motor Company Tenure 2013 Committee A  | | | | William M. Brown,

62 Chairman of the Board and Chief Executive Officer, 3M Company Tenure 2024 |

| | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Audrey Choi, 57 Independent Retired Chief Sustainability Officer and Management Committee Member,

Morgan Stanley Tenure 2023 Committee N&G STS | | | | Anne H. Chow, 58 Independent Retired Chief Executive Officer, AT&T Business Tenure 2023 Committee  STS STS | | | | David B. Dillon, 73 Independent Retired Chairman of the Board and Chief Executive Officer,

The Kroger Co. Tenure 2015 Committee  N&G N&G |

| | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | James R. Fitterling, 63 Lead Independent Director Chair of the Board and Chief Executive Officer, Dow Inc. Tenure 2021 Committee C&T | | | | Suzan Kereere, 59 Independent President, Global Markets, PayPal Holdings, Inc. Tenure 2022 Committee A C&T | | | | Gregory R. Page, 73 Independent Retired Chairman of the Board and Chief Executive Officer, Cargill Tenure 2016 Committee C&T  |

| | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Pedro J. Pizarro, 59 Independent President and Chief Executive Officer and Director, Edison International Tenure 2023 Committee A N&G | | | | Thomas W. Sweet, 65 Independent Retired Chief Financial Officer, Dell Technologies Inc. Tenure 2023 Committee A N&G | | | | |

| | | | |

| | | | |

| | | | | | | | | | |

Key

| | | | | | | | | | | | | | | | | |

| A | Audit | C&T | Compensation and Talent | STS | Science, Technology & Sustainability |

N&G | Nominating and Governance | | Chair | | |

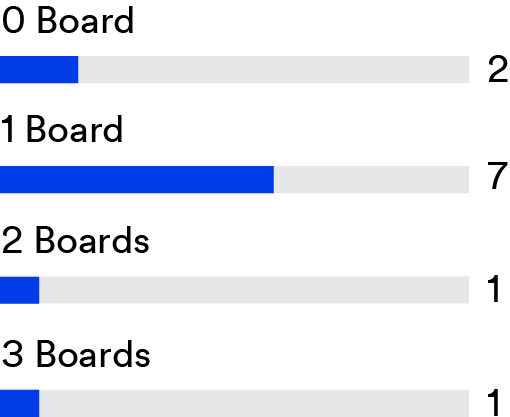

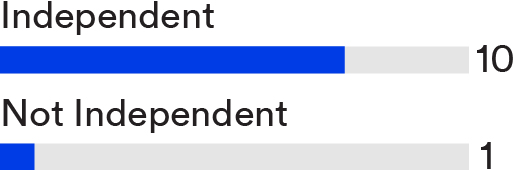

Board diversity of skills and experience

| | | | | | | | | | | | | | |

| | | | |

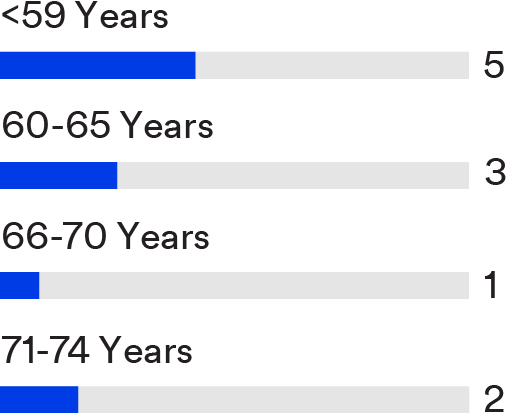

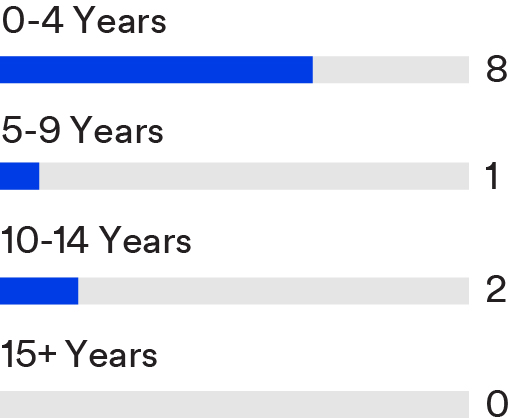

| Director nominee age | Director nominee

tenure | Other public company boards | Strong director nominee independence |

| 63.1 | 4.3 | 1.1 | 91% |

| Average years | Average tenure | Average board positions |

|

| | | | |

| | | | |

| Skills and experience across multiple key disciplines •All nominees experienced in leadership, finance, and risk management •9 or more nominees experienced in supply chain, technology, and global organizations | Lead independent director

•Lead Independent Director with robust authority •Combined Chairman and CEO positions | Meeting attendance 97% •Overall attendance at Board and committee meetings •7 Board meetings in 2024 | Active Board refreshment •8 of 11 nominees, including 7 independent nominees, have joined the Board since 2021 •New Lead Independent Director in 2024 |

|

| | | | |

| | | | |

| Skills and experience |

|

Qualifications and attributes, and demographic information, for the 11 director nominees that are standing for election at the Annual Meeting are summarized below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Qualifications and Attributes | Bozeman | T. Brown | W. Brown | Choi | Chow | Dillon | Fitterling | Kereere | Page | Pizarro | Sweet |

| Leadership | | | | | | | | | | | |

| Manufacturing | | | | | | | | | | | |

| Supply Chain | | | | | | | | | | | |

| Technology | | | | | | | | | | | |

| Finance | | | | | | | | | | | |

| Global | | | | | | | | | | | |

| Risk Management | | | | | | | | | | | |

| Marketing | | | | | | | | | | | |

| Demographic Background | | | | | | | | | | | | | |

| Tenure (Years) | <1 | 12 | <1 | 1 | 2 | 10 | 4 | 3 | 9 | 2 | 1 |

| Age (Years) | 56 | 69 | 62 | 57 | 58 | 73 | 63 | 59 | 73 | 59 | 65 |

Diversity | | | |

Female | Racially/ethnically diverse | LGBTQ+ or born ex-U.S. |

Corporate governance highlights

Board refreshment

We regularly add directors to infuse new ideas and fresh perspectives into the boardroom. Eight out of the 11 director nominees standing for this year’s election, including seven independent director nominees, have joined our board since 2021. In recruiting directors, we focus on how the background, experience and skill set of each individual complements that of their fellow directors to create a balanced board with differing viewpoints and backgrounds, deep expertise, and strong leadership experience.

Shareholder outreach and engagement

Shareholder engagement is fundamental to our commitment to good governance and essential to maintaining our strong corporate governance practices. Our Board is committed to the ongoing dialogue with our shareholders, which enables us to incorporate invaluable shareholder perspectives into the Board’s discussions related to strategic priorities, corporate governance, executive compensation, and sustainability initiatives. Shareholder feedback is shared with the appropriate Board committees or the full Board to ensure our governance policies reflect priorities that are important to our shareholders. We typically conduct our engagement activities in the second half of each year and, in 2024, we also engaged with shareholders in the spring related to our executive compensation program. Over the course of 2024, both prior to and following the 2024 Annual Meeting, our engagement team held 19 meetings with 16 of our top shareholders, representing approximately 50 percent of our outstanding shares held by institutional shareholders.

| | | | | | | | | | | | | | | | | |

| | | |

CONTACTED 30 institutional shareholders, representing ~62 percent of all outstanding shares held by institutional shareholders during 2024 | | ENGAGED 16 institutional shareholders, representing ~50 percent of all outstanding shares held by institutional shareholders during 2024 | | 3M ENGAGEMENT TEAM •Chair of the Compensation and Talent Committee •Lead Independent Director •Representatives of the legal affairs, human resources, and investor relations teams One or more independent directors attended 10 of the meetings, including all meetings with our top 25 shareholders | |

| | |

| | | | | |

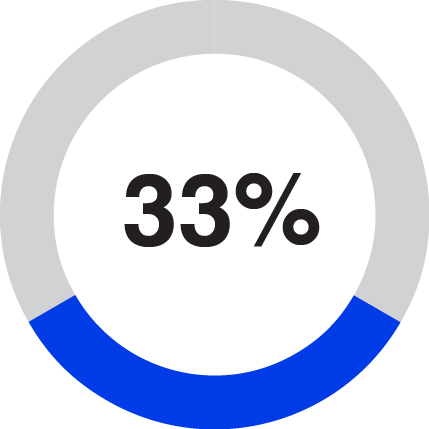

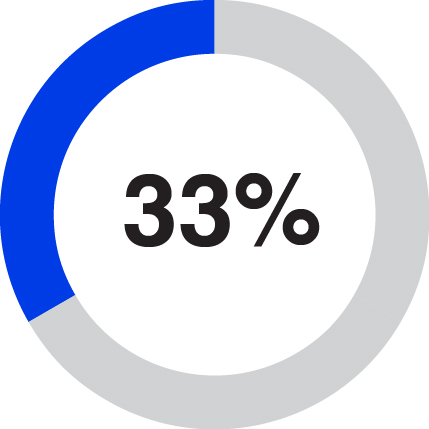

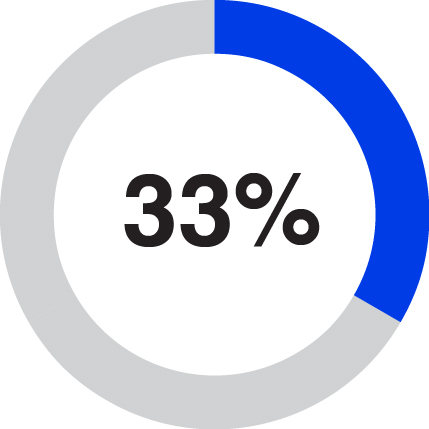

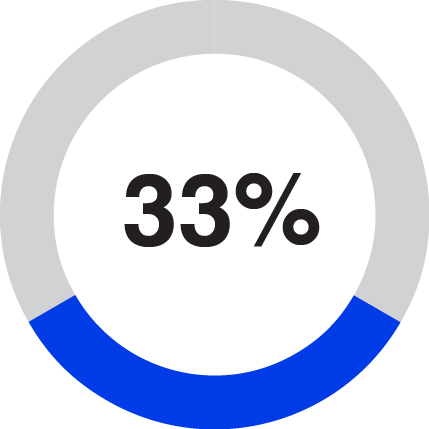

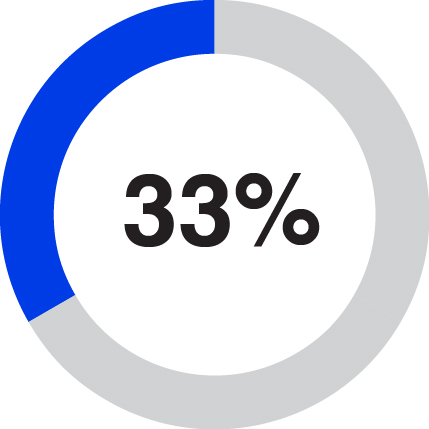

We offer to meet with shareholders with significant holdings, and typically only a subset of the owners we contact request engagement meetings. In the Spring, prior to our 2024 Annual Meeting, our engagement team contacted 19 institutional shareholders representing approximately 50 percent of all outstanding shares held by institutional shareholders. We held meetings with eight, representing approximately 33 percent of institutional holdings. In the fall of 2024, our engagement team contacted 19 institutional shareholders representing approximately 50 percent of institutional holdings. We held meetings with 11 shareholders, representing approximately 42 percent of institutional holdings. Our Chair of the Compensation and Talent Committee, current and then-outgoing Lead Independent Director, as well as representatives of the legal affairs, human resources and investor relations teams led the engagement effort. Our Chief Executive Officer also participates in engagement meetings with our shareholders to provide strategic business updates, but in 2024 refrained from attending portions of the meetings dedicated to executive compensation discussions.

Information on our engagement activities related to our executive compensation program can be found starting on page 65. With respect to feedback on topics beyond executive compensation, investors discussed Board composition and skills, CEO onboarding and succession planning, progress on stewardship goals and the impact of the spin-off of Solventum Corporation on those goals, CEO priorities, PFAS manufacturing and related legal matters. 3M’s sustainability highlights

We report on sustainability matters at www.3M.com/sustainability. We align our reporting with the Global Reporting Initiative (GRI), the Task Force for Climate-Related Financial Disclosures (TCFD), and the evolving global efforts of reporting frameworks and requirements. Information on Board oversight of sustainability can be found starting on page 38.

| | | | | | | | | | | | | | |

| | | |

| Ratification of the appointment of independent registered public accounting firm for 2025 (page 51) •Ratify the appointment of PricewaterhouseCoopers LLP (PwC) as 3M’s independent registered public accounting firm for 2025. •Based on its assessment of the qualifications and performance of PwC, the Audit Committee believes that it is in the best interests of the Company and its shareholders to retain PwC. | |

| |

| | “FOR” | |

Executive compensation

| | | | | | | | | | | | | | |

| | | |

| Advisory approval of executive compensation (page 56) •Approve, on an advisory basis, the compensation of our Named Executive Officers (NEOs). •Our executive compensation program appropriately aligns our executives’ compensation with the performance of the Company and its business units as well as their individual performance. | |

| |

| | “FOR” | |

Executive compensation program

We maintain compensation principles that support our pay-for-performance philosophy and ensure that our compensation practices are competitive to attract the best talent, motivate executives to perform at their highest levels, and reward individual contributions that improve the Company’s ability to deliver shareholder value.

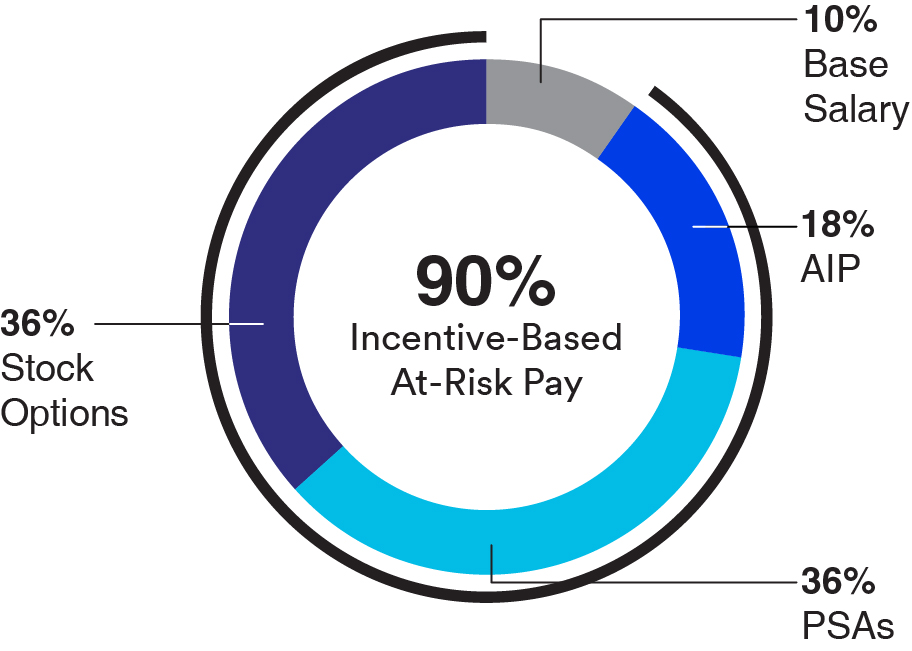

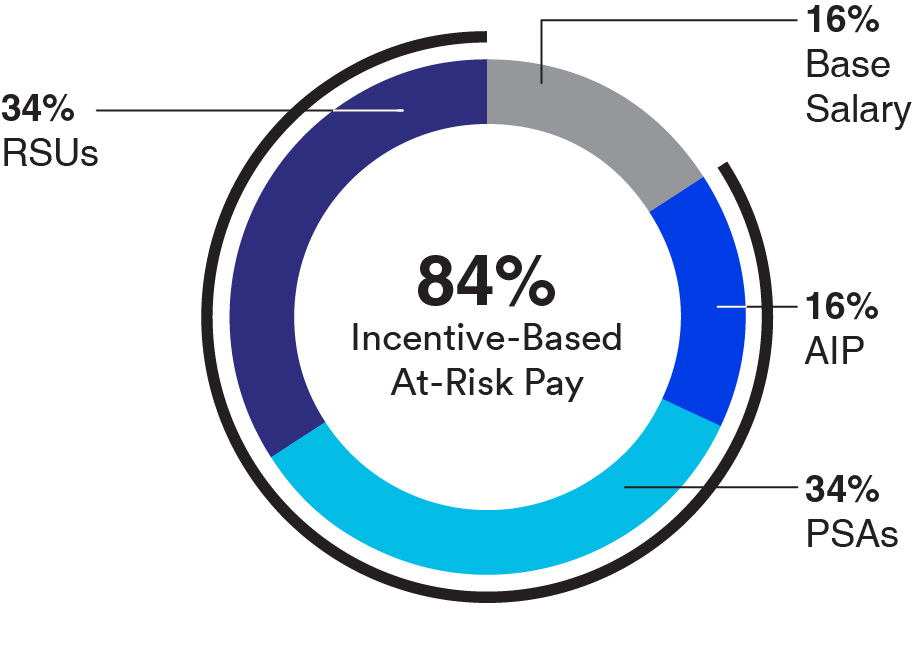

Predominantly at-risk 2024 target total direct compensation

Abbreviations: AIP = annual incentive pay; PSAs = performance share awards; RSUs = restricted stock units.

* Percentages shown reflect the apportionment for the CEO (or, in the case of the percentages shown for the Other NEOs, the average apportionment) of the components of target Total Direct Compensation that are expected to be recurring. Such amounts do not reflect special items such as hiring bonuses, one-time make-whole and inducement awards granted in connection with the commencement of employment, or special grants. See “2024 compensation decisions — What we pay and why” on page 62 for additional details.

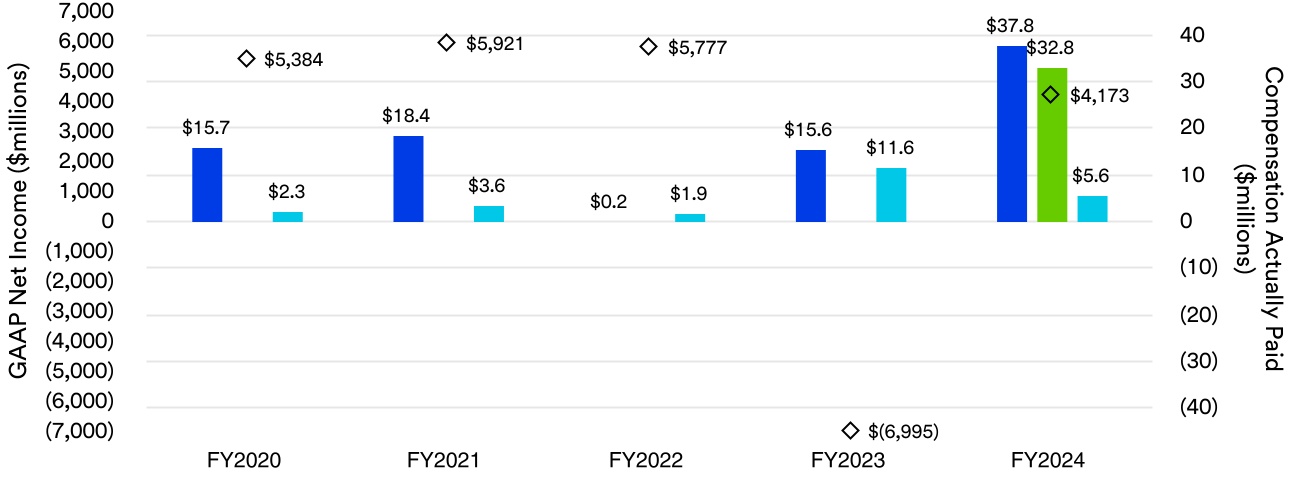

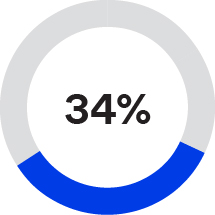

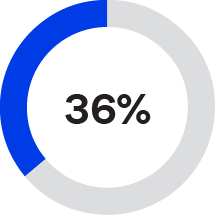

2024 incentive plan payouts aligned with performance

| | | | | | | | | | | | | | | | | | | | | | | |

| Annual incentive plan payout | | Performance share award payout (2022 PSAs) |

| | | | | | | |

| | | | | | | |

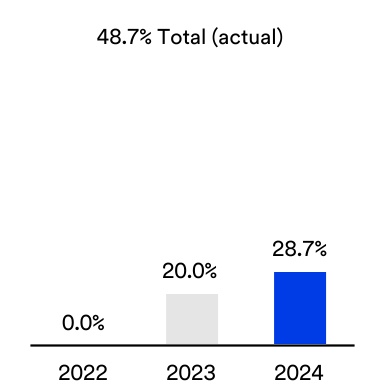

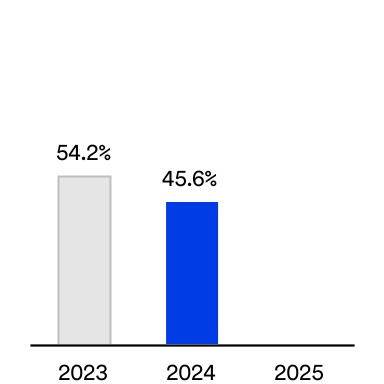

| 46.1% | | 128.6% | | (0.6)% | | 48.7% |

| | | |

| | | |

| 1-year TSR | | 2024 AIP Payout* | | 3-year TSR | | 2022 PSA Payout |

| | | | | | | |

Total shareholder return (TSR) = Share Price Appreciation + Dividend Yield (annualized)

Note: 1-year TSR is for the one year ending 12/31/24; 3-year TSR is for the three years ending 12/31/24

Source: Bloomberg

* Amount shown represents the payout (before any adjustment for individual performance) for the Named Executive Officers whose 2024 annual incentive compensation was calculated based on the Company’s overall performance. See “Annual incentive” beginning on page 72 for more information concerning the payouts for the Named Executive Officers who were instead paid, in part, based on the performance of a business group. | | | | | | | | | | | |

| | | |

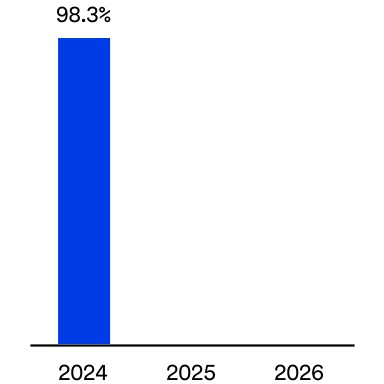

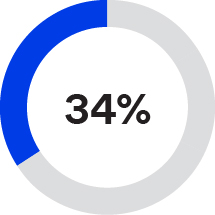

| Board responsiveness to 2024 say-on-pay vote | |

| | | |

| In response to the 2024 say-on-pay vote outcome and feedback provided by our shareholders through the expanded shareholder engagement effort, the Compensation and Talent Committee approved the following responsive actions: •Adopted a three-year cumulative performance period, starting with the 2025 performance share awards, replacing the annual performance measurement approach •Introduced a three-year relative TSR payout modifier applicable to the 2025 performance share awards to foster a closer alignment with shareholder experience •Enhanced transparency of the Committee’s decision-making process related to the adjustments applied to the performance results used to calculate payouts for the annual incentive program and performance share awards •Expanded disclosure around the annual incentive program and performance share metrics rigor | |

| | | |

| | | | | | | | | | | | | | |

| |

| |

| Elect the 11 director nominees identified in this Proxy Statement •Elect the 11 director nominees identified in this Proxy Statement, each for a term of one year. •Our nominees are distinguished leaders who bring a mix of skills and qualifications to the Board and can represent the interests of all shareholders. | |

| |

| | “FOR” each nominee to the Board | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | David P. Bozeman, 56 Independent President and Chief Executive Officer and Director, C.H. Robinson Worldwide STS | | | | Thomas “Tony” K. Brown, 69 Independent Retired Group Vice President, Global Purchasing, Ford Motor Company A  | | | | William M. Brown, 62 Chairman of the Board and Chief Executive Officer, 3M Company |

| | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Audrey Choi, 57 Independent Retired Chief Sustainability Officer and Management Committee Member, Morgan Stanley N&G STS | | | | Anne H. Chow, 58 Independent Retired Chief Executive Officer, AT&T Business  STS STS | | | | David B. Dillon, 73 Independent Retired Chairman of the Board and Chief Executive Officer, The Kroger Co.  N&G N&G |

| | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | James R. Fitterling, 63 Lead Independent Director Chair of the Board and Chief Executive Officer, Dow Inc. C&T | | | | Suzan Kereere, 59 Independent President, Global Markets, PayPal Holding, Inc. A C&T | | | | Gregory R. Page, 73 Independent Retired Chairman of the Board and Chief Executive Officer, Cargill C&T  |

| | | | |

| | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | Pedro J. Pizarro, 59 Independent President and Chief Executive Officer and Director, Edison International A N&G | | | | Thomas W. Sweet, 65 Independent Retired Chief Financial Officer, Dell Technologies Inc. A N&G | | | | |

| | | | |

| | | | |

Key

| | | | | | | | | | | | | | | | | |

| A | Audit | C&T | Compensation and Talent | STS | Science, Technology & Sustainability |

N&G | Nominating and Governance | | Chair | | |

| | | | | |

| Corporate governance at 3M |

| |

At the 2025 Annual Meeting, 11 directors are to be elected to hold office until the 2026 Annual Meeting of Shareholders and until their successors have been elected and qualified. Mr. David P. Bozeman is presently a 3M Director who is standing for election by shareholders for the first time. A director search firm assisted with the identification of Mr. Bozeman for recommendation by the Nominating and Governance Committee for his election to the Board. Mr. Bozeman was elected by the Board effective February 6, 2025. All other nominees are presently 3M Directors who were elected by shareholders at the 2024 Annual Meeting.

Effective March 1, 2025, Mr. Michael F. Roman, former Executive Chairman of the Board of Directors, retired from his role as Executive Chairman, and as a director. The Board appointed Mr. William M. Brown, 3M’s Chief Executive Officer, to serve as Chairman of the Board. To facilitate a smooth transition of the Chair role, Mr. Roman agreed to serve as Executive Advisor to the Board until he retires from 3M on May 1, 2025. We thank Mr. Roman for his many contributions to the Board and 3M, including in his role as Executive Chairman of the Board and also in his prior roles with 3M, including as Chairman of the Board and Chief Executive Officer.

In addition, Ms. Amy E. Hood, a 3M Director since 2017, is not seeking re-election for personal reasons unrelated to 3M. Her service on the 3M Board will conclude when her term expires at the 2025 Annual Meeting. We also thank Ms. Hood for her many contributions to the Board and to 3M.

No additional director replacements are being announced at this time. The Company will continue to refresh its Board of Directors regularly with the skills and experiences deemed most critical for setting strategic objectives and positioning 3M to drive long-term shareholder value.

We expect each of our director nominees to be able to serve if elected. If any nominee is not able to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless the Board chooses to reduce the number of directors serving on the Board. Each nominee elected as a director will continue in office until his or her successor has been elected and qualified, or until his or her death, resignation, or retirement.

The Nominating and Governance Committee reviewed the Board Membership Criteria (described on page 27) and the specific experience, qualifications, attributes, and skills of each nominee, including membership(s) on the boards of directors of other public companies. The following pages contain biographical and other information about the nominees. Following each nominee’s biographical information, we have provided information concerning the experience, qualifications, attributes, and skills that are deemed most critical to 3M’s long-term success and led the Nominating and Governance Committee and the Board to determine that each nominee should serve as a director. In addition, many of our directors serve or have served on boards and board committees (including as committee chairs) of other public companies, which the Board believes provides them with additional board leadership and governance experience, exposure to best practices, and substantial knowledge and skills that further enhance the functioning of our Board. | | | | | |

| |

Recommendation of the board |

| |

| |

| The Board of Directors unanimously recommends a vote “FOR” the election of these nominees as directors. Proxies solicited by the Board of Directors will be voted “FOR” these nominees unless a shareholder indicates otherwise in voting the proxy. |

| |

| | | | | |

| Corporate governance at 3M |

| |

Nominees for director

| | | | | | | | | | | | | | |

| | | | |

| David P. Bozeman 56 Independent President and Chief Executive Officer and Director, C.H. Robinson Worldwide, Inc. | Director since 2025 |

| | | | |

Career Highlights •Mr. Bozeman is the President and Chief Executive Officer and a member of the Board of Directors of C.H. Robinson Worldwide, Inc., one of the largest global logistics companies in the world, a position he has held since June 2023. •He previously served as Vice President, Ford Customer Service Division, and Vice President, Enthusiast Vehicles, for Ford Blue of Ford Motor Company, a global automotive industry leader, from 2022 to 2023. •He also served as Senior Vice President, Amazon Transportation Services of Amazon.com, Inc., a global e-commerce, cloud computing, consumer electronics, media, and digital advertising company, from 2017 to 2022. •Mr. Bozeman held roles of increasing seniority at Caterpillar, Inc., from 2008 to 2016, ultimately serving as Senior Vice President Enterprise Systems. •Earlier in his career, he spent 16 years at Harley-Davidson, Inc., from 1992 to 2008. •Mr. Bozeman serves on the board of directors of The Brookings Institution and The Conservation Fund. He also served on the Board of Directors of Weyerhaeuser from 2015 to 2017. Reasons for Nomination Mr. Bozeman’s master’s degree in engineering management from the Milwaukee School of Engineering and his bachelor’s degree in manufacturing design from Bradley University; his more than 30 years of experience at global manufacturing and technology companies, including experience across supply chains, manufacturing, digital, and customer service; his expertise in reinventing complex operating models; and his experience as a President, CEO and Director of a public company, qualify him to serve as a director of 3M. | Other public company boards •C.H. Robinson Worldwide, Inc. 3M Board committee(s) •Science, Technology & Sustainability |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Thomas “Tony” K. Brown 69 Independent Retired Group Vice President, Global Purchasing, Ford Motor Company | Director since 2013 |

| | | | |

Career Highlights •Mr. Brown is the retired Group Vice President, Global Purchasing, Ford Motor Company, a global automotive industry leader. Mr. Brown had served in various leadership capacities in global purchasing since joining Ford in 1999. •In 2008, he became Ford’s Group Vice President, Global Purchasing, with responsibility for approximately $90 billion of production and non-production procurement for Ford operations worldwide. He retired from Ford on August 1, 2013. •From 1997 to 1999, he served in leadership positions at United Technologies Corporation, including as its Vice President, Supply Management. •From 1991 to 1997, he served as Executive Director, Purchasing and Transportation at QMS Inc. •From 1976 to 1991, he served in various managerial roles at Digital Equipment Corporation. Reasons for Nomination Mr. Brown’s bachelor’s degree in business administration from American International College in Springfield, Massachusetts; his leadership roles, including his experience serving as a director of other public companies; and his knowledge of and extensive experiences in global purchasing, management, and supply chain at Ford Motor Company and other companies, qualify him to serve as a director of 3M. | Other public company boards •ConAgra Foods, Inc. (Nominating and Governance Committee) 3M Board committee(s) •Audit •Nominating and Governance (Chair) Other public company boards within the past five years •Tower International, Inc. |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| William M. Brown 62 Chairman of the Board and Chief Executive Officer, 3M Company | Director since 2024 |

| | | | |

Career Highlights •Mr. Brown has been the Chief Executive Officer of 3M Company since May 1, 2024, and Chairman of the Board since March 1, 2025. •Mr. Brown is the former Chairman of the Board and Chief Executive Officer of L3Harris Technologies, a global innovator in aerospace and defense technology solutions, where he served as Executive Chair from June 2021 to June 2022. He served as Chairman and Chief Executive Officer from June 2019 to June 2021. •Mr. Brown previously served as Chairman, President and Chief Executive Officer of Harris Corporation, prior to its merger with L3 Technologies in 2019. He joined Harris Corporation in November 2011 as President and Chief Executive Officer and was appointed Chairman in April 2014. •Prior to Harris Corporation, Mr. Brown spent 14 years at United Technologies Corporation, serving in a variety of leadership roles. Reasons for Nomination Mr. Brown’s bachelor’s and master’s degrees in mechanical engineering from Villanova University and MBA degree from The Wharton School, University of Pennsylvania; his wealth of strategic leadership, innovation, operational excellence, cybersecurity, and experience as a public company chief executive officer at complex global organizations for over a decade; his strong corporate governance background and experience in the U.S. and international business; and his service on other public company boards, qualify him to serve as a director of 3M. | Other public company boards •Becton, Dickinson and Company Other public company boards within the past five years •Celanese Corporation •L3Harris Technologies, Inc. |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Audrey Choi 57 Independent Retired Chief Sustainability Officer and Management Committee Member, Morgan Stanley | Director since 2023 |

| | | | |

Career Highlights •Ms. Choi is the retired Chief Sustainability Officer and Management Committee Member of Morgan Stanley, a global financial services firm with offices in 41 countries. •Ms. Choi was Morgan Stanley’s first Chief Sustainability Officer and a member of its Global Management Committee, from 2017 to 2022. She was also Chief Marketing Officer from 2017 to 2021. •Over the course of her 16-year career at Morgan Stanley, she founded and led the Global Sustainable Finance Group, the Institute for Sustainable Investing and the Community Development Finance Group. •She is currently Executive Chair of the Generation Foundation and a partner of Generation Investment Management. •Previously, Ms. Choi served in senior policy-making positions in the Clinton Administration including as Chief of Staff, Council of Economic Advisers, Domestic Policy Advisor, Office of the Vice President, Director of Strategic Policy & Planning, National Telecommunications & Information Administration, Department of Commerce, White House Fellow, and Co-Director of the Education Technology Task Force, Federal Communications Commission. •Prior to her public service career, she was a foreign correspondent and bureau chief for The Wall Street Journal. •Ms. Choi has a long record of service in the philanthropic and non-profit sectors including as a board member of New York Cares, the Kresge Foundation, StoryCorps, and as visiting scholar at the Federal Reserve Bank of New York. •She was previously a board member of the Sustainable Accounting Standards Board (SASB) and the Wildlife Conservation Society. Reasons for Nominations Ms. Choi’s MBA from Harvard Business School and A.B. from Harvard College; her executive leadership roles and experience at Morgan Stanley, especially in sustainability and marketing; and her other board positions, qualify her to serve as a director of 3M. | Other public company boards •None 3M Board committee(s) •Nominating and Governance •Science, Technology & Sustainability |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Anne H. Chow 58 Independent Retired Chief Executive Officer, AT&T Business | Director since 2023 |

| | | | |

Career Highlights •Ms. Chow is the retired Chief Executive Officer of AT&T Business, which provides solutions to businesses across all industries as well as the public sector. •She is also the founder and CEO of The Rewired CEO, a business service firm, and is a Senior Fellow and Adjunct Professor of Executive Education at the Kellogg School of Management, Northwestern University. •Ms. Chow served as the CEO of AT&T Business from 2019 to 2022 after having served in various executive leadership positions at AT&T since 2000, including National Business President, Integrator Solutions President, and Premier Client Group Senior Vice President. At AT&T Business, Ms. Chow was responsible for nearly 3 million business customers in more than 200 countries and territories around the world, including nearly all the world’s Fortune 1000 companies. Her responsibilities encompassed AT&T’s full suite of business services across wireless, networking, cybersecurity, and advanced solutions, covering more than $35 billion in revenues with a global organization of over 35,000 people. •She has a long track record of community leadership involvement in board and advisory roles at organizations such as the Girl Scouts of the USA, New Jersey Chamber of Commerce, and the Federal Reserve Bank of Dallas. •Reflective of her impact in driving success at the intersection of people, culture, and technology, Ms. Chow was named to Fortune’s Most Powerful Women in Business twice, Forbes inaugural CEO Next List of leaders set to revolutionize American business, and inducted into the Dallas Business Hall of Fame. •She is the Vice Chair and a member of Georgia Tech President's Advisory Board, a member of the Dallas Mavericks Advisory Council, a member of C200, and a member of the Committee of 100. Reasons for Nomination Ms. Chow’s master’s degree in business administration from The Johnson School at Cornell University, her bachelor’s and master’s degrees in electrical engineering from Cornell University; her decades of executive leadership positions at AT&T, including as CEO of AT&T Business; and her extensive global and cross-functional experience in management, technology, cybersecurity, marketing and sales, operations, strategy, business and culture transformation, finance, and sustainability matters; as well as her experience as a director at other public companies, qualify her to serve as a director of 3M. | Other public company boards •Franklin Covey Co. (lead independent director) •CSX Corporation 3M Board committee(s) •Compensation and Talent (Chair) •Science, Technology & Sustainability |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| David B. Dillon 73 Independent Retired Chairman of the Board and Chief Executive Officer, The Kroger Co. | Director since 2015 |

| | | | |

Career Highlights •Mr. Dillon is the retired Chairman of the Board and Chief Executive Officer, The Kroger Co., a large retailer that operates food and drug stores, multi-department stores, jewelry stores, and food production facilities throughout the U.S. Mr. Dillon retired on December 31, 2014 as Chairman of the Board of Kroger, where he was Chairman since 2004, and was the Chief Executive Officer, from 2003 through 2013. •Mr. Dillon served as President of Kroger from 1995 to 2003 and was elected Executive Vice President in 1990. Mr. Dillon served as Director of The Kroger Co., from 1995 through 2014. •Mr. Dillon began his retailing career at Dillon Companies, Inc. (later a subsidiary of The Kroger Co.) in 1976 and advanced through various management positions, including President, from 1986 to 1995. Reasons for Nomination Mr. Dillon’s bachelor’s degree in business from the University of Kansas and his law degree from Southern Methodist University; his leadership roles and experiences at The Kroger Co., including serving as Chairman of the Board and Chief Executive Officer; his knowledge of and extensive experiences in leading one of the world’s largest retailers; his experiences in Kroger’s successful $13 billion merger with Fred Meyer, Inc.; his leadership in sustainability; his skills in financial and audit matters; and his experiences as a director at other public companies, qualify him to serve as a director of 3M. | Other public company boards •Union Pacific Corporation 3M Board committee(s) •Audit (Chair) •Nominating and Governance |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| James R. Fitterling 63 Lead Independent Director Chair and Chief Executive Officer, Dow Inc. | Director since 2021 |

| | | | |

Career Highlights •Mr. Fitterling is the Chair and Chief Executive Officer of Dow Inc., one of the world’s leading global materials science companies. Mr. Fitterling was named CEO-elect of Dow in March 2018 prior to becoming CEO in July 2018, and he was elected Chair in April 2020. •Before that, he served as President and Chief Operating Officer of Dow and as Chief Operating Officer for the Materials Science division of DowDuPont. In his 40 year career with the company, Mr. Fitterling has spent 10 years in Asia, and has held leadership positions with P&L responsibility in many of the company’s operations. •A strong advocate for inclusion and diversity, Mr. Fitterling was named #1 LGBT+ Executive in 2018 on the “OUTstanding in Business” list published by Financial Times. •Mr. Fitterling serves as the Immediate Past Chair of the Board of Directors of the National Association of Manufacturers, past Chair of the Board of Directors for the American Chemistry Council, Chair of Alliance to End Plastic Waste, and a Trustee of the Committee for Economic Development. Reasons for Nomination Mr. Fitterling’s bachelor’s degree in mechanical engineering from the University of Missouri-Columbia; his extensive leadership roles and experiences at Dow, including serving as its Board Chair and CEO; his many years of international business experiences; his deep understanding and appreciation of materials science and innovation; and his strong track record of advancing environmental, social and governance goals, qualify him to serve as a director of 3M. | Other public company boards •Dow Inc. 3M Board committee(s) •Compensation and Talent |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Suzan Kereere 59 Independent President of Global Markets, PayPal Holdings, Inc. | Director since 2022 |

| | | | |

Career Highlights •Ms. Kereere is the President of Global Markets, PayPal Holdings, Inc., a leading digital payment partner for businesses and consumers around the world, a position she has held since January 2024. •Ms. Kereere was the Head of Global Business Solutions, Fiserv, Inc., a global fintech and payments company with solutions for banking, global commerce, merchant acquiring, billing and payments, and point of sale, from 2021 to 2023. She also held an executive leadership role as Fiserv's Chief Growth Officer. •She was the Global Head of Merchant Sales and Acquiring at VISA, a global payments technology company, from 2018 to 2021 and Head of European Merchant and Acquiring department, from 2016 to 2018. •She served in leadership positions at American Express, from 1988 to 2016, including as head of its U.S. National Merchant Business and of its Global Network Business. She has led businesses in Europe, Australia, Asia and North America. •Ms. Kereere is a former director at Grange Insurance Company and Electronic Transactions Association. •She currently serves as a Board Trustee for Alvin Ailey American Dance Theater and board member at Code for America. Reasons for Nominations Ms. Kereere’s bachelor’s degree in economics from Tufts University and MBA degree from Columbia University Business School; her decades of experience and expertise in leading payments and technology platform businesses at Fortune 100 companies across global business lines and regional high growth start-ups; her accomplishments in digital transformation, sales optimization, front-line customer engagement and inclusive growth; and her track record of championing for equality of opportunity in the corporate space and bringing analytics to the discussion, qualify her to serve as a director of 3M. | Other public company boards •None 3M Board committee(s) •Audit •Compensation and Talent |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Gregory R. Page 73 Independent Retired Chairman of the Board and Chief Executive Officer, Cargill | Director since 2016 |

| | | | |

Career Highlights •Mr. Page is the retired Chairman of the Board and Chief Executive Officer, Cargill, an international marketer, processor and distributor of agricultural, food, financial and industrial products and services. •Mr. Page was named Corporate Vice President & Sector President, Financial Markets and Red Meat Group of Cargill in 1998; Corporate Executive Vice President, Financial Markets and Red Meat Group in 1999; President and Chief Operating Officer in 2000; and became Chairman of the Board and Chief Executive Officer in 2007. •He served as Executive Chairman of the Board of Cargill from December 2013 until his retirement in September 2015, and Executive Director of Cargill, from September 2015 to September 2016. •Mr. Page is a board member at Alight, a nonprofit company primarily serving refugees and displaced people, and Wayne Sanderson Farms, the nation’s third largest poultry producing company. •Mr. Page is the past director and non-executive Chair of the Board of Big Brothers Big Sisters of America until 2022. He is the past President and board member of the Northern Star Council of the Boy Scouts of America. Reasons for Nominations Mr. Page’s bachelor’s degree in economics from the University of North Dakota; his leadership roles and experiences while serving as Chairman of the Board and Chief Executive Officer at Cargill; his expertise and knowledge of financial and audit matters and corporate governance; and his experiences as a director at public companies, qualify him to serve as a director of 3M. | Other public company boards •Deere & Company •Eaton Corporation plc (lead director) •Corteva Agriscience (non-executive chair) 3M Board committee(s) •Compensation and Talent •Science, Technology & Sustainability (Chair) |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Pedro J. Pizarro 59 Independent President and Chief Executive Officer and Director

Edison International | Director since 2023 |

| | | | |

Career Highlights •Dr. Pizarro is the President and Chief Executive Officer and Director of Edison International, the parent company of Southern California Edison (SCE), one of the nation’s largest electric utilities, a position he has held since 2016. Edison International is also the parent company of Trio (formerly Edison Energy), a competitive provider of integrated sustainability and energy advisory services to large commercial, industrial, and institutional organizations in North America and Europe. •Prior to that, he served as President of SCE from 2014 to 2016. From 2011 to 2014, Dr. Pizarro served as President of Edison Mission Energy, an indirect subsidiary of Edison International, until the sale of its principal assets in 2014. •He has held a wide range of other senior executive positions at the Edison International companies since joining in 1999, including Executive Vice President responsible for SCE’s transmission and distribution system, power procurement and generation. Dr. Pizarro has previously served as Vice President and Senior Vice President of Power Procurement, and Vice President of Strategy and Business Development. •Dr. Pizarro is former Chair of the Edison Electric Institute, Co-Chair of the Electricity Subsector Coordinating Council, and a Trustee of the California Institute of Technology. •Prior to his work at the Edison International companies, Dr. Pizarro was a senior engagement manager with McKinsey & Company. Reasons for Nominations Dr. Pizarro’s bachelor’s degree in chemistry from Harvard University and his Ph.D. in chemistry from the California Institute of Technology; his extensive leadership experiences with Edison International, including as President and Chief Executive Officer; his extensive board service; and his knowledge and experiences with leadership, risk management, technology, safety and operations, workforce management, cybersecurity, regulatory and government affairs, business resiliency, mergers and acquisitions, and strategic planning, qualify him to serve as a director of 3M. | Other public company boards •Edison International 3M Board committee(s) •Audit •Nominating and Governance |

| | | | | |

| Corporate governance at 3M |

| |

| | | | | | | | | | | | | | |

| | | | |

| Thomas W. Sweet 65 Independent Retired Chief Financial Officer, Dell Technologies Inc. | Director since 2023 |

| | | | |

Career Highlights •Mr. Sweet is the retired Chief Financial Officer of Dell Technologies Inc., an enterprise technology giant. As CFO, from 2014 to 2023, Mr. Sweet oversaw all aspects of the company's finance function, including accounting, financial planning and analysis, tax, treasury and investor relations, as well as global business operations, Dell Financial Services and Dell Technologies Capital. •He also led corporate strategy, partnering closely with the office of the CEO to develop and execute a long-term growth and value creation strategy for the company. •Mr. Sweet joined Dell in 1997 and held various leadership positions before assuming the CFO role, including Vice President of Corporate Finance, Controller, Head of Internal Audit, and Chief Accounting Officer. •He oversaw external financial reporting in the years before Dell’s historic five-year shift to privatization and served in sales leadership roles in education and in various corporate business units. •Mr. Sweet serves on the Board of Directors of Trimble Inc., an industrial technology company; Medline Industries, a private global healthcare company that offers products, services and solutions for various points of care; and the Salvation Army of Central Texas Advisory Board. Reasons for Nomination Mr. Sweet bachelor’s degree in business administration from Western Michigan University; his qualification as a Certified Public Accountant; his years of leadership roles and experiences as CFO at Dell; his expertise and knowledge of finance and audit matters; and experience serving as a director on other boards, qualify him to serve as a director of 3M. | Other public company boards •Trimble Inc. 3M Board committee(s) •Audit •Nominating and Governance |

| | | | | |

| Corporate governance at 3M |

| |

Board membership criteria

3M’s Corporate Governance Guidelines contain Board Membership Criteria that include a list of key skills and characteristics deemed critical to serve 3M’s long-term business strategy and expected to be represented on 3M’s Board. The Nominating and Governance Committee periodically reviews with the Board the appropriate skills and characteristics required of Board members given the current Board composition. It is the intent of the Board that the Board will be a high-performance organization creating a competitive advantage for the Company. To perform as such, the Board will be composed of individuals who have distinguished records of leadership and success in their areas of experience and expertise, who will make substantial contributions to Board operations, and who can effectively represent the interests of all shareholders. The assessment of the Board candidates by the Nominating and Governance Committee and the Board includes, but is not limited to, consideration of the following:

•Roles in and contributions valuable to the business community;

•Personal qualities of leadership, character, judgment, and whether they possess and maintain a reputation in the community at large of integrity, trust, respect, competence, and adherence to the highest ethical standards, throughout their service on the Board;

•Relevant knowledge and diversity of background and experience in business, manufacturing, technology, finance and accounting, marketing, international business, and other areas; and

•Whether the candidate is free of conflicts and has the time required for preparation and participation at all meetings.

In addition, the Nominating and Governance Committee will also evaluate whether the nominee’s skills are complementary to the existing Board members’ skills and the Board’s needs for particular expertise in certain areas, and will assess the nominee’s impact on Board dynamics, effectiveness, and diversity of experience and perspectives.

Director nominee skills and experience

The diagram below summarizes the director nominees’ key skills and experiences in the areas that are most relevant to 3M and shows the number of director nominees who possess each of the skills and experiences:

| | | | | |

| Corporate governance at 3M |

| |

Diversity of experiences and backgrounds

At 3M, our unique capabilities as a science company are multiplied by bringing together people who have different technical expertise, industry knowledge, mindsets, backgrounds, and experiences. Likewise, the Board of Directors regards diversity in all facets as an important factor in selecting board nominees to serve on the Board. When recruiting nominees for directors, it actively considers diversity of background and experience in such things as business, manufacturing, technology, finance and accounting, marketing, international business, and other matters, as well as the demographics of the Board. The current composition of our Board reflects those ongoing efforts and the continued importance of having directors with different backgrounds and experiences, skills and expertise, and perspectives on the Board.

Board self-evaluation process

The Board conducts a multi-step annual self-evaluation to determine whether it, its committees and its directors are functioning effectively, to consider opportunities for continual enhancement, and as part of its annual director nomination process.

| | | | | | | | | | | |

| | | |

| 1 | Evaluations by Board Leadership •Chairman/Lead Independent Director/Nominating and Governance (N&G) Committee Chair meet annually to evaluate the performance and skills of each director •Information is shared and discussed with the N&G Committee and considered in the nomination process |

| | | |

| | | |

| 2 | One-on-One Discussions with N&G Chair •N&G Chair meets individually with each director to discuss: •Effectiveness of Board and committees •Opportunities for improvement •Director’s self-evaluation •Director’s evaluation of other Board members •Other topics selected by director •N&G Chair shares comments and feedback with the Board and N&G Committee |

| | | |

| | | |

| 3 | Annual Questionnaires •Each director completes a questionnaire on the functioning of the Board and committees •Results are discussed at subsequent Board and committee meetings |

| | | |

| | | |

| 4 | Feedback Incorporated •As a result of this process: •The Board and its committees identify potential areas for improvement, as well as existing practices which have contributed to high effectiveness •Items requiring follow-up are monitored on a going-forward basis by the full Board, committees and/or committee chairs, as applicable •The N&G Committee considers the performance and contributions of each director as part of its annual nomination process to ensure our directors continue to possess the necessary skills and experience to effectively oversee the Company; on occasion, the N&G Committee has decided to not re-nominate a director in part as a result of feedback from this self-assessment |

| | |

While this formal self-evaluation is conducted on an annual basis, directors share perspectives, feedback, and suggestions year-round. The Board and each committee conducted an evaluation of its performance in 2024.

| | | | | |

| Corporate governance at 3M |

| |

Director nomination process

In addition to its annual assessment and nomination of incumbent directors, the N&G Committee oversees the process for selecting new director candidates.

Identification, evaluation, and selection of nominees

Director nomination process

| | | | | | | | | | | | | | |

| | | | |

1 | 2 | 3 | 4 | 5 |

Identify and prescreen The N&G Committee Chair and CEO, working with any Board-retained recruiting firm, identify and prescreen individuals who are believed to be qualified to become Board members in accordance with the Board Membership Criteria set forth above, and review potential candidates with the Board. | Committee interview The N&G Committee, as a group, is offered an opportunity to interview potential candidates, and subsequently reviews potential qualified director nominees with the Board. | Board leadership interview The Lead Independent Director and relevant Committee Chairs interview potential candidates, provide feedback to the Board, and solicit further feedback from the Board. | Select and recommend The N&G Committee selects nominees that the N&G Committee believes suit the Board’s needs and, following completion of due diligence on any potential candidates, the N&G Committee recommends candidates to the Board. | Determine submissions for election The Board reviews such recommendations and determines submissions for election at the next shareholder meeting of the Company in which directors will be elected or elections will be held to fill any vacancies or to add talent to the Board. |

| | | | |

The N&G Committee also focuses on overall Board-level succession planning, periodically reviews the appropriate size and composition of the Board, and anticipates future vacancies and needs of the Board. In the event the Committee recommends an increase in the size of the Board or a vacancy occurs, the Committee considers qualified nominees from several sources, including current Board members and nominees recommended by shareholders and other persons.

The N&G Committee may from time to time retain a director search firm to help the N&G Committee identify qualified director nominees for consideration by the N&G Committee. In 2024, the N&G Committee retained Russell Reynolds to help identify future Board candidates.

Shareholder nominations — shareholder recommendations

The N&G Committee has a policy to consider properly submitted shareholder recommendations for candidates for membership on the Board of Directors. Shareholders proposing individuals for consideration by the N&G Committee must include at least the following information about the proposed nominee: the proposed nominee’s name, age, business or residence address, principal occupation or employment, and whether such person has given written consent to being named in the Proxy Statement as a nominee and to serving as a director if elected. Shareholders should send the required information about the proposed nominee to:

| | | | | |

| Corporate Secretary 3M Company 3M Center Building 220-9E-02 St. Paul, MN 55144-1000 |

| | | | | |

| Corporate governance at 3M |

| |

For an individual proposed by a shareholder to be considered by the N&G Committee for recommendation as a Board nominee for the 2026 Annual Meeting, the Corporate Secretary must receive the proposal by November 26, 2025. Such proposals must be sent via registered, certified, or express mail (or other means that allows the shareholder to determine when the proposal was received by the Company). The Corporate Secretary will refer properly submitted shareholder proposed nominations to the Chair of the N&G Committee for consideration at a future N&G Committee meeting. Individuals proposed by shareholders in accordance with these procedures will receive the same consideration received by individuals identified to the N&G Committee through other means.

Shareholder nominations — advance notice bylaw

In addition, 3M’s Bylaws permit shareholders to nominate directors at an annual meeting of shareholders or at a special meeting at which directors are to be elected in accordance with the notice of meeting. Shareholders intending to nominate a person for election as a director must comply with the requirements set forth in the Company’s Bylaws. With respect to nominations to be acted upon at our 2026 Annual Meeting, our Bylaws would require, among other things, that the Corporate Secretary receive written notice from the record shareholder no earlier than November 26, 2025, and no later than December 26, 2025. The notice must contain the information required by the Bylaws, a copy of which is available on our website at www.3M.com, under Investor Relations — Governance — Governance Documents. Nominations received after December 26, 2025, will not be acted upon at the 2026 Annual Meeting.

Shareholder nominations — universal proxy rules

In addition to satisfying the foregoing advance notice requirements under 3M’s Bylaws, to comply with the universal proxy rules under the Securities Exchange Act of 1934, as amended (Exchange Act), shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice to the Company that sets forth the information required by Securities and Exchange Commission Rule 14a-19 (Universal Proxy) under the Exchange Act, as specified in the Bylaws. Shareholders utilizing universal proxy are also required to follow other requirements contained in 3M’s Bylaws. For the purposes of Rule 14a-19 (Universal Proxy), the Board’s role in terms of including a shareholder nominee on the proxy card is to ensure the shareholder nominee is qualified, based on requirements specified by applicable law, the Certificate of Incorporation or the Bylaws, not the nominee’s suitability to serve on the Board. Nominations received after the notice deadline will not be acted upon at the 2026 Annual Meeting.

Shareholder nominations — proxy access

Further, pursuant to the proxy access Bylaw adopted by the Board in November 2015, a shareholder, or a group of up to 20 shareholders, continuously owning for three years at least three percent of our outstanding common shares may nominate and include in our proxy materials up to the greater of two directors and 20 percent of the number of directors currently serving, if the shareholder(s) and nominee(s) satisfy the Bylaw requirements. For eligible shareholders to include in our proxy materials nominees for the 2026 Annual Meeting, proxy access nomination notices must be received by the Company no earlier than November 26, 2025, and no later than December 26, 2025. The notice must contain the information required by the Bylaws.

| | | | | |

| Corporate governance at 3M |

| |

Director orientation and continuing education

Our orientation programs familiarize new directors with 3M’s businesses, strategic plans, and policies, and help prepare them for their role on their assigned committees. Continuing education programs assist directors in maintaining skills and knowledge necessary for the performance of their duties. These programs may be part of regular Board and Committee meetings or provided by third parties. The programs have at times also included visits to the Company’s laboratories and manufacturing facilities.

Director independence

The Board has adopted a formal set of Director Independence Guidelines with respect to the determination of director independence, which either conform to or are more exacting than the independence requirements of the New York Stock Exchange (NYSE) listing standards, and the full text of which is available on our website at www.3M.com, under Investor Relations — Governance — Governance Documents. In accordance with these Guidelines, a director or nominee for director must be determined to have no material relationship with the Company other than as a director. The Guidelines specify the criteria by which the independence of our directors will be determined, including strict guidelines for directors and their immediate family members with respect to past employment or affiliation with the Company or its independent registered public accounting firm. The Guidelines also prohibit Audit Committee and Compensation and Talent Committee members from having any direct or indirect financial relationship with the Company and restrict both commercial and not-for-profit relationships of all directors with the Company. Directors may not be given personal loans or extensions of credit by the Company, and all directors are required to deal at arm’s length with the Company and its subsidiaries, and to disclose any circumstance that might be perceived as a conflict of interest.

In accordance with these Guidelines, the Board undertook its annual review of director independence. During this review, the Board considered transactions and relationships between each director, or any member of his or her immediate family and the Company and its subsidiaries and affiliates in each of the most recent three completed fiscal years. The Board also considered whether there were any transactions or relationships between the Company and a director or any members of a director’s immediate family (or any entity of which a director or an immediate family member is an executive officer, general partner, or significant equity holder). The Board considered that in the ordinary course of business, transactions may occur between the Company and its subsidiaries and companies at which some of our directors are or have been officers. In particular, the Board considered the annual amount of sales to 3M for each of the most recent three completed fiscal years by each of the companies where directors serve or have served as an executive officer, as well as purchases by those companies from 3M. The Board determined that the amount of sales and purchases in each fiscal year was below one percent of the annual revenues of each of those companies, below the threshold set forth in the Director Independence Guidelines. The Board also considered charitable contributions to not-for-profit organizations with which our directors or immediate family members are affiliated, none of which exceeded the threshold set forth in our Director Independence Guidelines.

As a result of this review, the Board affirmatively determined that the following directors are independent under these Guidelines: David P. Bozeman, Thomas “Tony” K. Brown, Audrey Choi, Anne H. Chow, David B. Dillon, James R. Fitterling, Amy E. Hood, Suzan Kereere, Gregory R. Page, Pedro J. Pizarro, and Thomas W. Sweet. The Board has also determined that members of the Audit Committee and Compensation and Talent Committee received no compensation from the Company other than for service as a director. Mr. William M. Brown is not considered to be independent because of his employment by the Company.

Corporate governance practices and policies

The Company believes that good corporate governance practices serve the long-term interests of shareholders, strengthen the Board and management, and further enhance the public trust 3M has earned from more than a century of operating with uncompromising integrity and doing business the right way. The following sections provide an overview of 3M’s corporate governance policies, including the Corporate Governance Guidelines, our shareholder outreach and engagement practices, the Codes of Conduct for directors and employees, public policy engagement, and other important governance-related policies, which are published on the Company’s website.

| | | | | |

| Corporate governance at 3M |

| |

Corporate governance highlights

| | | | | | | | | | | | | | | | | |

| | | | |

| | Board composition and independence |

| •Board with variety of technical expertise, industry knowledge, backgrounds, and experiences •8 directors have joined our board since 2021, including 7 independent directors | •91 percent independent board •100 percent independent board committees •Lead Independent Director with robust authority | •Regular executive sessions for independent directors •Full access to management and employees |

| | | | | |

| | | | | |

| | Board and board committee practices |

| •Annual board, committee and individual director self-evaluation process •Comprehensive onboarding program •Support continuing education opportunities | •Strong Audit Committee financial expertise •Regular board refreshment with a balanced mix of tenure •Mandatory director retirement policy | •Consideration of collective Board background and experience in director nomination process •Regular shareholder outreach and engagement with director participation |

| | | | | |

| | | | | |

| | Shareholder rights |